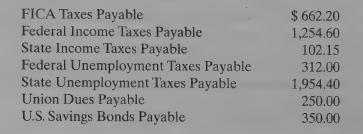

The following payroll liability accounts are included in the ledger of Pettiegrew Company on January 1, 2008.

Question:

The following payroll liability accounts are included in the ledger of Pettiegrew Company on January 1, 2008.

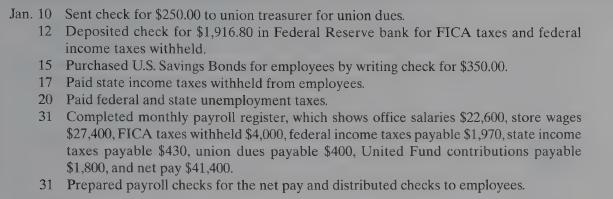

In January, the following transactions occurred.

At January 31, the company also makes the following accruals pertaining to employee compensation.

1. Employer payroll taxes: FICA taxes 8%, state unemployment taxes 5.4%, and federal unemployment taxes 0.8%.

2. Vacation pay: 5% of gross earnings.

Instructions

(a) Journalize the January transactions.

(b) Journalize the adjustments pertaining to employee compensation at January 31.

Transcribed Image Text:

FICA Taxes Payable Federal Income Taxes Payable State Income Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable Union Dues Payable U.S. Savings Bonds Payable $ 662.20 1,254.60 102.15 312.00 1,954.40 250.00 350.00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 9780471980193

8th Edition

Authors: Jerry J Weygandt, Donald E Kieso, Paul D Kimmel

Question Posted:

Students also viewed these Business questions

-

The following payroll liability accounts are included in the ledger of Wimble Company on January 1, 2012. FICA Taxes Payable............ $ 760.00 Federal Income Taxes Payable........ 1,204.60 State...

-

The following payroll liability accounts are included in the ledger of Harmon Company on January 1, 2014. FICA Taxes Payable ............... $ 760.00 Federal Income Taxes Payable ........... 1,204.60...

-

The following payroll liability accounts are included in the ledger of Eikleberry Company on January 1, 2011. FICA Taxes Payable .............$ 662.20 Federal Income Taxes Payable .........1,254.60...

-

Clara Hughes, who is pushing 5 0 , has medaled both in speedskating and road cycling ( and showing no signs of slowing down ) completed a training event where she biked 5 0 km east, stopped and rode...

-

a. Assume that the takt time is 60 seconds for a cell, but a finishing process has a cycle time of 65 seconds, and there is no way known to reduce that time. What would you do, ideally, and why? b....

-

A(n)________ ________ is two or more organs working together to perform required functions in the body.

-

Luther, 72, is a lifelong bachelor who has been very successful in his business and Communication Skills investment endeavors. He realizes that he should begin to do some tax planning for his death....

-

Alonzo Saunders owns a small training services company that is experiencing growing pains. The company has grown rapidly by offering liberal credit terms to its customers. Although his competitors...

-

Prepare a multiple-step income statement for Armstrong Co. from the following data for the year ended December 31. Sales, $755,000; cost of goods sold, $330,000; administrative expenses, $35,000;...

-

Maggie Sharrer Company borrows \($88,500\) on September 1, 2008, from Sandwich State Bank by signing an \($88,500,\) 12%, one-year note. What is the accrued interest at December 31, 2008? a....

-

Del Hardware has four employees who are paid on an hourly basis plus time-and-a half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2008, are presented below....

-

Using a computer simulation, plot the voltage transfer characteristics of the class-AB output stage with Darlington pairs shown in Figure 8.36. Bias V+ V+ D D2 VBB D3 03 26 Q2 -00 RL Figure 8.36...

-

The current rate of interest on S-T Treasury Bills = 10%, intermediate term Gov. Bonds = 11%, Lt- Gov. Bonds = 12%, AA rate Corp. Bonds = 13.5% and the rate of inflation is 5%. Holding-period returns...

-

Prepare Income Statement(absorption costing) for the second, third and fourth month. SALES (SP X unit sold) INCOME STATEMENT FORMAT (ABSORPTION COSTING) XXX Less: Cost of Goodsold VARIABLE COST (VC...

-

The following shows the distribution of final exam scores in a large introductory psychology class. The proportion under the curve is given for two segments (short answers-no calculations required)....

-

How much overhead was included in the cost of Job #461 at the beginning of January? * (1 Point). BREAD Co. uses a job order costing system. At the beginning of January, the company had 2 jobs in...

-

3. (3pt.) A state of a physical system is just a description of the system at an instant in time in terms of its properties. In classical mechanics, states are represented by points (in phase space)....

-

Following is financial information describing the six operating segments that make up Fairfield, Inc. (in thousands): Consider the following questions independently. None of the six segments has a...

-

Write each fraction as a percent. 7 50

-

Break-Even Sales Currently, the unit selling price of a product is $350, the unit variable cost is $290, and the total fixed costs are $900,000. A proposal is being evaluated to increase the unit...

-

L. IL 5. During of Serbia Comorost 3.500 of direct to the companyes de conto 200 and used 50.000 arborThe job W noted by the end of the mo d er n at de and OSR1000 12.000 0 .000 Oto

-

#1 Data related to the inventories of Alpine Ski Equipment and Supplies is presented below: Skis Boots Apparel Supplies Selling price $ 173,000 $ 162,000 $ 118,000 $ 69,000 Cost 146,000 138,000...

Study smarter with the SolutionInn App