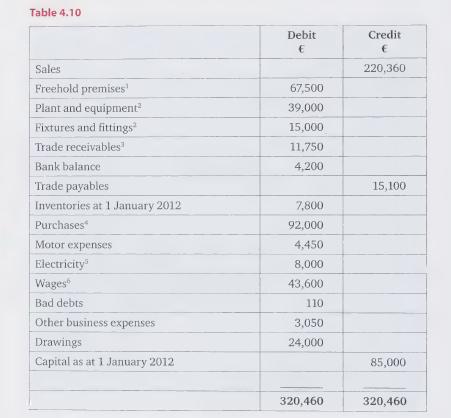

The trial balance of Russells as at 31 December 2012 is shown in Table 4.10. *No depreciation

Question:

The trial balance of Russells as at 31 December 2012 is shown in Table 4.10.

*No depreciation is to be charged on freehold premises.

*All depreciation is to be provided on the straight-line basis. Plant and equipment is to be depreciated at 30% per annum and fixtures and fittings at 20% per annum.

*Aprovision for doubtful debts of 4% of trade receivables is to be established.

*Inventories held at 31 December 2012 were valued at €8,200.

*Electricity owing at the year-end amounted to €1,200.

*Wages due to staff at 31 December 2012 amounted to €4,800.

REQUIRED:

Prepare the income statement for Russells for the year ended 31 December 2012 and a statement of financial position as at that date.

Step by Step Answer:

Accounting A Smart Approach

ISBN: 9780199587414

1st Edition

Authors: Mary Carey, Jane Towers Clark, Cathy Knowles