The partners in Omni Services decided to liquidate the partnership on May 31, 2024, when balances in

Question:

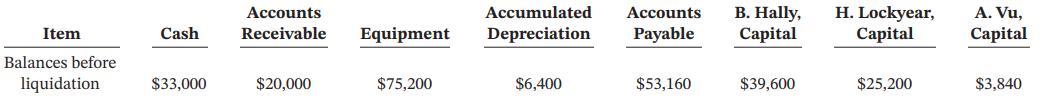

The partners in Omni Services decided to liquidate the partnership on May 31, 2024, when balances in the company’s accounts were as follows:

The partners share profit and loss 5:3:2 for Hally, Lockyear, and Vu, respectively.

Instructions

a. Complete the schedule and prepare the journal entries for the liquidation of the partnership assuming the noncash assets were sold for $88,800, liabilities are paid, and the cash is distributed appropriately.

b. Complete the schedule and prepare the journal entries assuming the assets were sold for $60,000, liabilities are paid, and any deficiencies will be paid by the deficient partner. Include the journal entry to record the distribution of cash.

c. Complete the schedule and prepare the journal entries assuming the assets were sold for $40,000, liabilities are paid, and any deficiencies will be absorbed by the other partners. Include the journal entry to record the distribution of cash.

In a liquidation, why are the liabilities paid before the partners?

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak