The partners in Omni Services decided to liquidate the partnership on May 31, 2021, when balances in

Question:

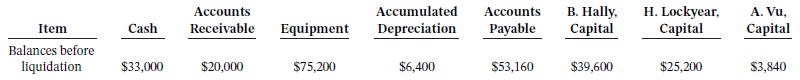

The partners in Omni Services decided to liquidate the partnership on May 31, 2021, when balances in the company?s accounts were as follows:

The partners share profit and loss 5:3:2 for Hally, Lockyear, and Vu, respectively.

Instructions

a. Complete the schedule and prepare the journal entries for the liquidation of the partnership assuming the noncash assets were sold for $88,800, liabilities are paid, and the cash is distributed appropriately.

b. Complete the schedule and prepare the journal entries assuming the assets were sold for $60,000, liabilities are paid, and any deficiencies will be paid by the deficient partner. Include the journal entry to record the distribution of cash.

c. Complete the schedule and prepare the journal entries assuming the assets were sold for $40,000, liabilities are paid, and any deficiencies will be absorbed by the other partners. Include the journal entry to record the distribution of cash.

Taking It Further

In a liquidation, why are the liabilities paid before the partners?

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak