Ardrossan plc acquired holdings in two companies as follows: Barmulloch Ltd 75% of the ordinary share

Question:

Ardrossan plc acquired holdings in two companies as follows:

Barmulloch Ltd – 75% of the ordinary share capital purchased on 1 August 2000 for

£4 million.

Cumbernauld Ltd – 25% of the ordinary share capital purchased on 1 August 1999 for

£1 million.

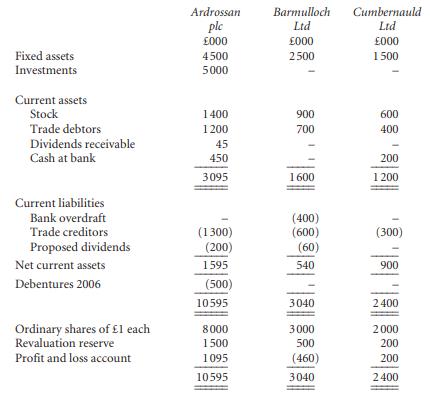

The draft balance sheets of the companies as at 31 July 2002 were:

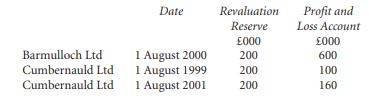

Additional information (1) The reserves of Barmulloch Ltd and Cumbernauld Ltd at the following dates were:

Assume profits accrued evenly in the year ended 31 July 2002.

(2) On 1 February 2002, Ardrossan plc sold its entire holding of shares in Cumbernauld Ltd for £1.3 million cash. This transaction has not yet been recorded in the accounts of Ardrossan plc. For any tax due on this transaction, assume a corporation tax rate of 30% and ignore indexation allowance.

(3) It is group policy to amortise any goodwill arising on consolidation over ten years with a full year’s charge in the year of acquisition and none in the year of disposal.

(4) The trade creditors of Ardrossan plc include £25 000 payable to Barmulloch Ltd. The trade debtors of Barmulloch record the same amount as a debt receivable. None of these transactions. resulted in any stock at the year end.

Requirements

(a) Calculate any profit or loss arising on the disposal of Cumbernauld Ltd to be included in the consolidated accounts of Ardrossan plc. (4 marks)

(b) Prepare the consolidated balance sheet of Ardrossan plc as at 31 July 2002.

(12 marks)

(c) Explain the basis of your calculations in (a), making appropriate reference to accounting standards and concepts. (4 marks)

ICAEW, Financial Reporting, September 2002 (20 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey