Blanch Corporation purchased 25 percent of the voting common shares of Chadwick Company on January 1, 20X2,

Question:

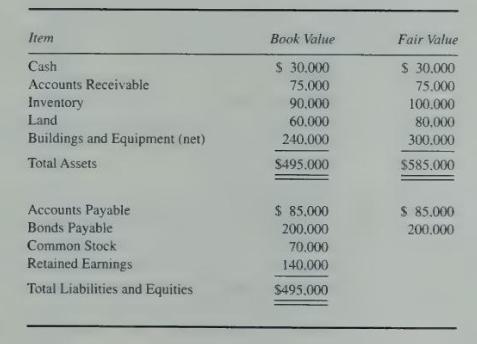

Blanch Corporation purchased 25 percent of the voting common shares of Chadwick Company on January 1, 20X2, for \(\$ 80,600\). At January 1, 20X2, Chadwick Company reported the following balance sheet amounts and fair values:

At January 1, 20X2, the estimated remaining economic life of buildings and equipment held by Chadwick was 10 years. Chadwick records inventory on a first-in-first-out basis. The amount paid by Blanch Corporation in excess of the fair value of the reported net assets of Chadwick Company is assigned to other identifiable assets with a useful life of eight years at January 1, 20X2.

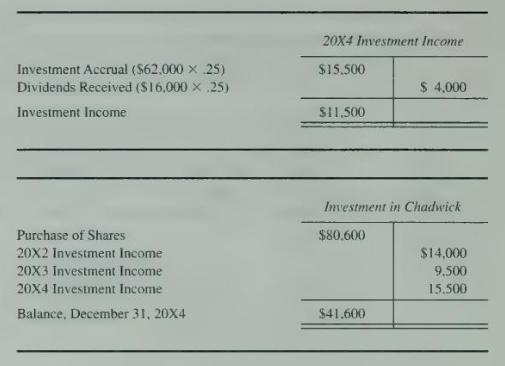

For 20X2, 20X3, and 20X4. Chadwick reported net income of \(\$ 56.000 . \$ 38.000\) and \(\$ 62.000\). respectively. Dividends of \(\$ 16,000\) were paid each year. The computation of investment income recorded by Blanch Corporation in 20X4 and entries in its investment account since the date of purchase are as follows:

The chief financial officer of Blanch Corporation believes an error has been made in recording investment income under the equity method.

\section*{Required}

a. Give the entry or entries that Blanch Corporation should have recorded in \(20 \mathrm{X} 4\) if the cost method was used in accounting for its investment in Chadwick Company.

b. Give the entry or entries that Blanch Corporation should have recorded in \(20 \mathrm{X} 4\) if the equity method was used in accounting for its investment in Chadwick Company.

c. In light of the entries recorded by Blanch over the three-year period, give the adjusting or correcting entry needed to properly state the balance in the investment account and all related account balances at December \(31,20 \times 4\), assuming the equity method is used and closing entries for \(20 \mathrm{X} 4\) have not yet been made.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King