Hill Company paid $164,000 to acquire 40 percent ownership of Dale Company on January 1, 20X2. Net

Question:

Hill Company paid \$164,000 to acquire 40 percent ownership of Dale Company on January 1, 20X2. Net book value of Dale's assets on that date was \(\$ 300,000\). Book values and fair values of net assets held by Dale were the same, except for equipment and patents. Equipment held by Dale Company had a book value of \(\$ 70,000\) and fair value of \(\$ 120,000\). All of the remaining purchase price was attributable to the increased value of patents with a remaining useful life of eight years. The remaining economic life of all depreciable assets held by Dale Company was five years.

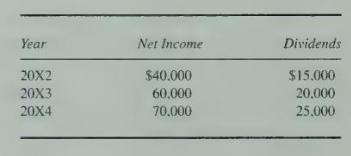

Net income and dividends of Dale Company for the three years immediately following the purchase of shares were:

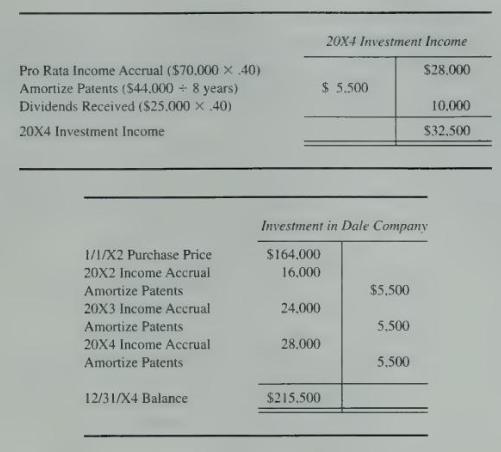

The computation of Hill's investment income for \(20 \mathrm{X} 4\) and entries in its investment account since the date of purchase were as follows:

Before making closing entries at the end of 20X4, the new controller of Hill Company reviewed the reports and was convinced that the balance in the investment account and investment income reported by Hill Company for \(20 \mathrm{X} 4\) were in error.

\section*{Required}

Prepare a correcting entry, along with supporting computations, to properly state the balance in the investment account and all related account balances at the end of \(20 \mathrm{X} 4\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King