Cusso Corporation had a bank loan of $50,000,000, which was to be repaid at the end of

Question:

Cusso Corporation had a bank loan of $50,000,000, which was to be repaid at the end of 20x5. The loan carried an interest rate based on the three-month London Interbank Offer Rate (LIBOR) plus 150 basis points. Interest on the loan was payable half-yearly on 30 June and 31 December. Cusso, concerned that interest rates might increase during the next three years, decided to enter into a swap with a financial intermediary on 1 January 20x3, which involved Cusso paying a fixed rate of 5.5% per annum and receiving LIBOR plus 150 basis points. The notional amount of the swap was $50,000,000. LIBOR was reset semi-annually beginning with 1 January 20x3 in order to determine the next interest payment.

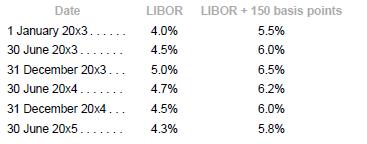

Differences between the fixed rate and the variable rate would be settled on a semi-annual basis. The following interest rates occurred over the term of the swap.

The following assumptions are made:

(a) The yield curve is flat.

(b) No hedge ineffectiveness (the conditions for the FASB’s “short-cut” method are assumed to be met).

(c) Other risks remain constant.

Cusso designates the swap as a cash flow hedge.

Required

Prepare the journal entries required to account for the loan and the swap over the period of the swap.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah