Ennis Corporation acquired 35 percent of the stock of Jackson Corporation on January 1, 20X8. by issuing

Question:

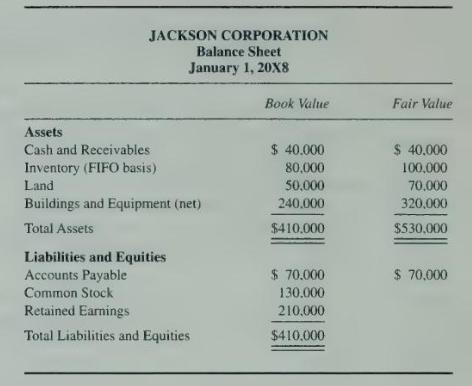

Ennis Corporation acquired 35 percent of the stock of Jackson Corporation on January 1, 20X8. by issuing 25,000 shares of its \(\$ 2\) par value shares. The balance sheet for Jackson Corporation immediately before the acquisition contained the following items:

Shares of Ennis Corporation were selling at \(\$ 8\) at the time of the acquisition. On the date of acquisition, the remaining economic life of buildings and equipment held by Jackson was 20 years. The amount of the differential assigned to goodwill is not amortized. For the year 20X8, Jackson reported net income of \(\$ 70,000\) and paid dividends of \(\$ 10,000\).

\section*{Required}

a. Give the journal entries recorded by Ennis Corporation during \(20 \mathrm{X} 8\) related to its investment in Jackson Company.

b. What balance will Ennis report as its investment in Jackson at December 31, 20X8?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King