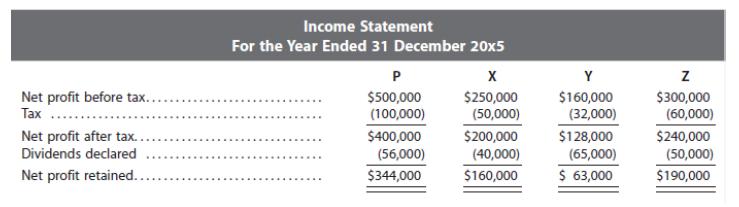

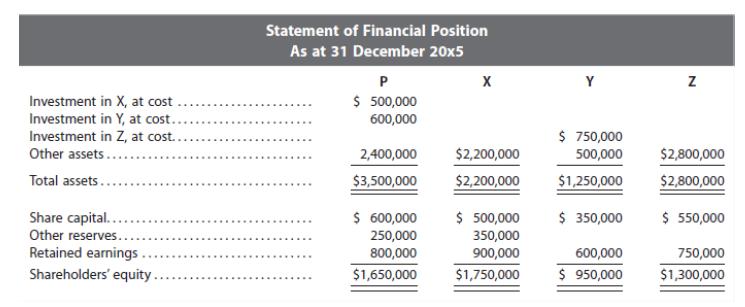

Extracts of financial statements of P, X, Y and Z for the year ended 31 December 20x5

Question:

Extracts of financial statements of P, X, Y and Z for the year ended 31 December 20x5 are as follows:

Additional information:

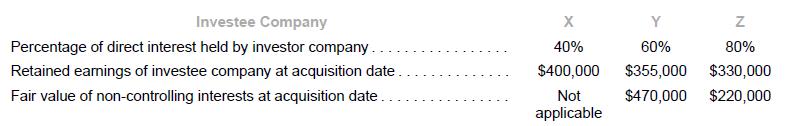

(a) All intercorporate investments were acquired prior to 1 January 20x5. Y was acquired before Z. There was no change in share capital since the date of acquisition. Ownership interests in investee companies, retained earnings, and fair value of non-controlling interests at the date of acquisition are as follows:

(b) Book values at acquisition date were close to fair values. No goodwill impairment charges were made since acquisition date.

(c) Assume no changes in retained earnings other than profit and dividends.

(d) Assume a tax rate of 20%.

Required

1. Calculate the amounts of dividend income recorded by each investor company. Assume that dividend income is tax exempt.

2. Applying the default assumptions relating to “control” and “significance influence,” show all relevant adjustment and elimination entries (with narratives and workings) for the year ended 31 December 20x5 that need to be passed to prepare the consolidated financial statements in accordance with the relevant IFRS pronouncements.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah