On 2 January 20x1, P Ltd paid $316,000 to acquire 160,000 ordinary shares (issued at $1 per

Question:

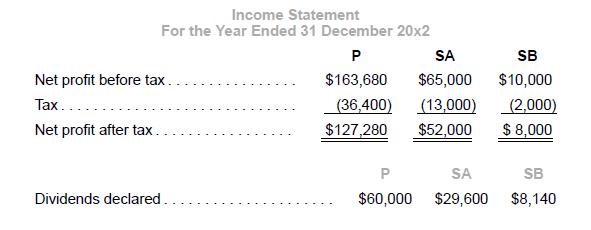

On 2 January 20x1, P Ltd paid $316,000 to acquire 160,000 ordinary shares (issued at $1 per share) in SA Ltd. At that point, SA Ltd’s retained earnings were $100,000. SA Ltd had an issued share capital of 200,000 ordinary shares (issued at $1 per share). On 2 January 20x1, SA Ltd acquired a 90% interest in SB Ltd for $204,800. The share capital and retained earnings of SB Ltd were $100,000 and $80,000, respectively at the date of acquisition. The book values of identifiable net assets were close to their fair values. On 31 December 20x1, the retained earnings for SA Ltd and SB Ltd were $130,000 and $100,000, respectively. Tax rate was 20%. Assume that the acquisition costs paid by P Ltd, relative to the equity interests held, are proportionate to the fair value of SA Ltd and SB Ltd. The cost method is used to account for the investment in subsidiaries. The following information is available for the year ended 31 December 20x2:

Required

Using the simultaneous method of consolidation, prepare consolidation entries to:

1. Eliminate Investment in SA and SB.

2. Allocate profits to non-controlling interests.

3. Eliminate dividends.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah