Fran Corporation acquired all the outstanding ($ 10) par value voting common stock of Brey Inc. on

Question:

Fran Corporation acquired all the outstanding \(\$ 10\) par value voting common stock of Brey Inc. on January 1, 20X9. in exchange for 25,000 shares of its \(\$ 20\) par value voting common stock. On December \(31,20 X 8\). Fran's common stock had a closing market price of \(\$ 30\) per share on a national stock exchange. The acquisition was appropriately accounted for as a purchase. Both companies continued to operate as separate business entities maintaining separate accounting records with years ending December 31. Fran accounts for its investment in Brey stock using the equity method without adjusting for unrealized intercompany profits.

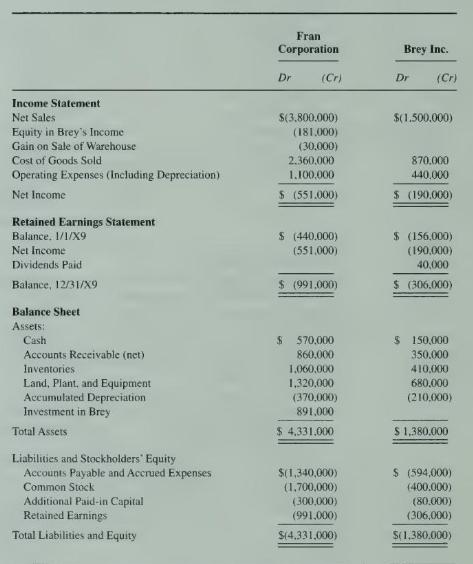

On December 31,20X9, the companies had condensed financial statements as follows:

There were no changes in the Common Stock and Additional Paid-In Capital accounts during 20X9 except the one necessitated by Fran's acquisition of Brey.

At the acquisition date, the fair value of Brey's machinery exceeded its book value by \(\$ 54,000\). The excess cost will be amortized over the estimated average remaining life of six years. The fair values of all of Brey's other assets and liabilities were equal to their book values. At December 31, 20X9, the management of Fran Corporation reviewed the amount attributed to goodwill as a result of its purchase of Brey's common stock and concluded an impairment loss of \(\$ 35,000\) should be recognized in 20X9.

On July 1, 20X9, Fran sold a warehouse facility to Brey for \(\$ 129,000\) cash. At the date of sale, Fran's book values were \(\$ 33,000\) for the land and \(\$ 66,000\) for the undepreciated cost of the building. Based on a real estate appraisal, Brey allocated \(\$ 43,000\) of the purchase price to land and \(\$ 86,000\) to building. Brey is depreciating the building over its estimated five-year remaining useful life by the straight-line method with no salvage value.

During 20X9, Fran purchased merchandise from Brey at an aggregate invoice price of \(\$ 180,000\), which included a 100 percent markup on Brey's cost. At December 31, 20X9, Fran owed Brey \(\$ 86,000\) on these purchases, and \(\$ 36,000\) of this merchandise remained in Fran's inventory.

\section*{Required}

Develop and complete a consolidation workpaper that would be used to prepare a consolidated income statement and a consolidated retained earnings statement for the year ended December 31, 20X9, and a consolidated balance sheet as of December 31, 20X9. List the accounts in the workpaper in the same order as they are listed in the financial statements provided. Formal consolidated statements are not required. Ignore income tax considerations. Supporting computations should be in good form.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King