In 20X0, Neil Company held the following investments in common stock: 25,000 shares of B&K Inc.s 100,000

Question:

In 20X0, Neil Company held the following investments in common stock:

25,000 shares of B&K Inc.’s 100,000 outstanding shares. Neil’s level of ownership gives it the ability to exercise significant influence over the financial and operating policies of B&K.

6,000 shares of Amal Corporation’s 309,000 outstanding shares.

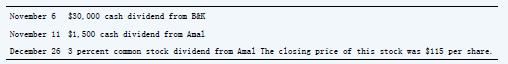

During 20X0, Neil received the following distributions from its common stock investments:

What amount of dividend revenue should Neil report for 20X0?

a. $1,500

b. $4,200

c. $31,500

d. $34,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 9781260165111

12th Edition

Authors: Theodore Christensen, David Cottrell, Cassy Budd

Question Posted: