Integrated Industries Inc. entered into a business combination agreement with Hydrolized Chemical Corporation (HCC) to assure an

Question:

Integrated Industries Inc. entered into a business combination agreement with Hydrolized Chemical Corporation (HCC) to assure an uninterrupted supply of key raw materials and to realize certain economies from combining the operating processes and the marketing efforts of the two companies. Under the terms of the agreement, Integrated Industries issued 180,000 shares of its \(\$ 1\) par common stock in exchange for all the assets and liabilities of HCC. The Integrated Industries shares then were distributed to the shareholders of \(\mathrm{HCC}\), and \(\mathrm{HCC}\) was liquidated.

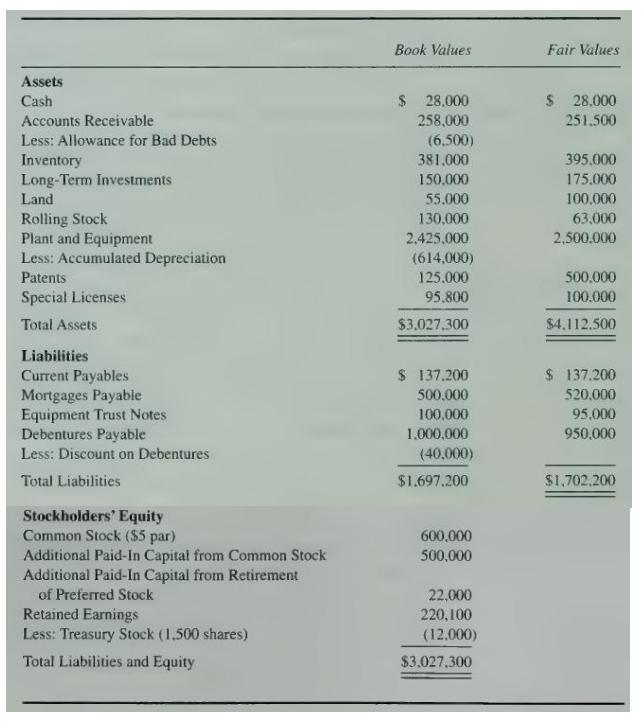

Immediately prior to the combination, HCC's balance sheet appeared as follows, with fair values also indicated:

Immediately prior to the combination, Integrated Industries common stock was selling for \(\$ 14\) per share. Integrated Industries incurred direct costs of \(\$ 135,000\) in arranging the business combination and \(\$ 42,000\) of costs associated with registering and issuing the common stock used in the combination.

\section*{Required}

a. Prepare all journal entries that Integrated Industries should have entered on its books to record the combination as a purchase.

b. Present all joumal entries that should have been entered on the books of HCC to record the combination and the distribution of the stock received, assuming the combination was treated as a purchase.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King