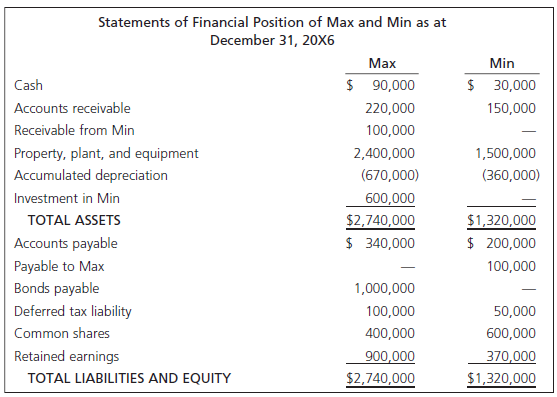

Max Corporation has a wholly owned subsidiary, Min Ltd., which was formed several years ago. Both Max

Question:

During 20X6, Min paid dividends of $100,000 to Max and purchased goods from Max at a total price of $1,200,000. All of the purchases from Max were subsequently sold to third parties during the year.

Required

Prepare a consolidated SFP for Max Corporation at December 31, 20X6. Additionally, show the consolidation-related adjusting entries required for preparing the consolidated SFP.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay

Question Posted: