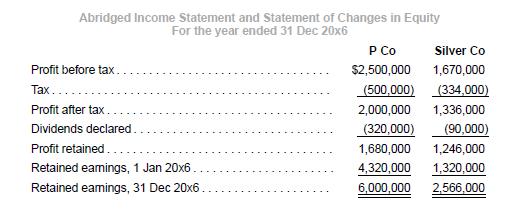

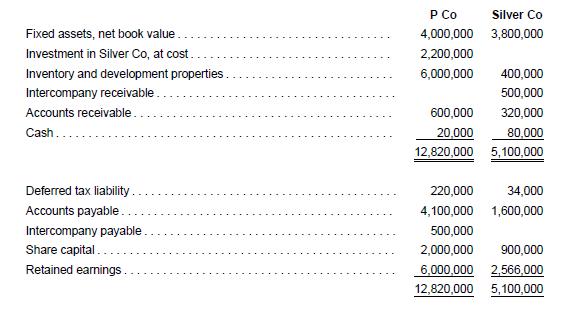

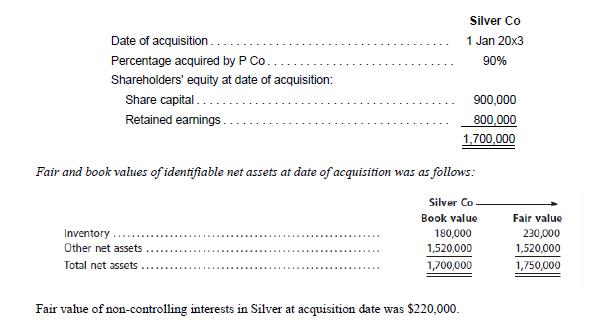

P Co acquired interests in Silver Co. The current financial statements are shown below. All figures are

Question:

P Co acquired interests in Silver Co. The current financial statements are shown below. All figures are in dollars, unless as otherwise indicated.

Additional information

1. The under-valued inventory of Silver Co was disposed as follows:

90% was resold to third party customers by 31 December 20x5.

10% remained unsold as at 31 December 20x6.

The net realizable value of remaining inventory as at 31 December 20x6 was $20,000.

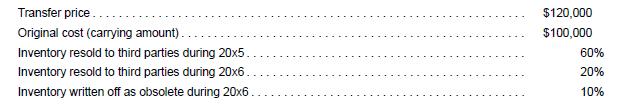

2. On 15 September 20x5, Silver Co transferred the following inventory to P Co:

3. Silver Co provides sub-contracting services to P Co, a property developer. During 20x5 and 20x6, Silver Co recognized profit from contract work for P Co. The development project to build a block of flatted factory on a 20-year leasehold land was completed on 30 June 20x6. Applying the requirements of IFRS 15 Revenue from Contracts with Customers, Silver Co recognized revenue progressively using the percentage of completion method to recognize income while P Co recognized revenue when the units were sold. On 31 December 20x6, 40% of the units were unsold.

4. Apply a tax rate of 20% on all appropriate adjustments. Recognize tax effects on fair value adjustments.

Companies recognize impairment losses, if any, at the financial year-end.

Required

1. Prepare consolidation adjusting entries for the year ended 31 December 20x6, with narratives (brief headers).

2. Perform an analytical check on the balance of non-controlling interests as at 31 December 20x6.

3. Perform an analytical check on the balance of consolidated retained earnings as at 31 December 20x6.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah