P Co obtained control of S Co on 1 July 20x6, which has two divisions: Trading and

Question:

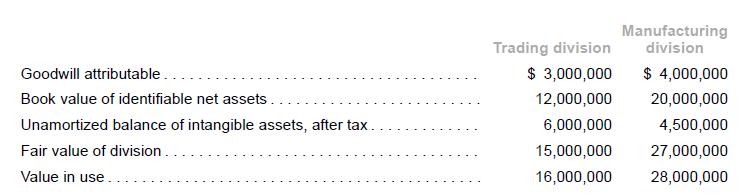

P Co obtained control of S Co on 1 July 20x6, which has two divisions: Trading and Manufacturing. Each is a “cash-generating unit” as defined by IAS 36 Impairment of Assets. P Co chose to measure non-controlling interests as a proportion of identifiable net assets on acquisition date. Goodwill attributable to P Co that was recognized was $7,000,000. On acquisition, P Co also recognized internally generated intangible assets at fair value. P Co has to assess the impairment of goodwill as at 31 December 20x8. The following information was available as at 31 December 20x8.

Required:

1. Determine the impairment loss, if any, for goodwill of the trading division and the manufacturing division as at 31 December 20x8.

2. Determine the impairment loss, if any, for identifiable net assets of the trading division and the manufacturing division as at 31 December 20x8.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah