P Co purchased an 80% interest in S Co, which has two divisions: Paints and Chemicals. Each

Question:

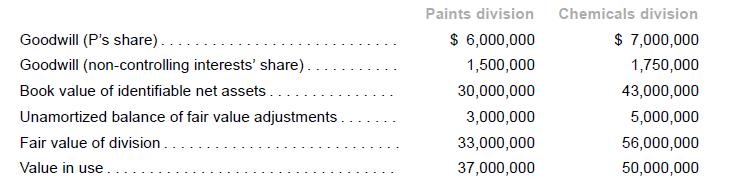

P Co purchased an 80% interest in S Co, which has two divisions: Paints and Chemicals. Each of these two divisions has cash flows that are independent of each other. Hence, they are deemed as “cash-generating units” in accordance with IAS 36 Impairment of Assets. The goodwill paid by P Co for S Co was allocated to the two divisions as shown below. The following table shows the balances as at 31 December 20x5.

Required:

1. What is the impairment loss on goodwill, if any, that should be recognized by P Co in its consolidated financial statements for the year ended 31 December 20x5?

2. The allocation of goodwill to different cash-generating units may be an arbitrary process. Suggest how the allocation may be carried out meaningfully by P Co.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah