Relevant balance sheets as at 31 March 1994 are set out opposite: You have recently been appointed

Question:

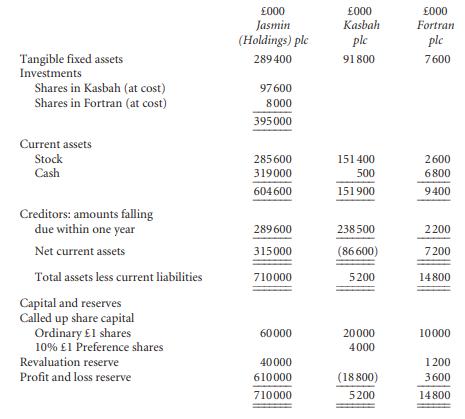

Relevant balance sheets as at 31 March 1994 are set out opposite:

You have recently been appointed chief accountant of Jasmin (Holdings) plc and are about to prepare the group balance sheet at 31 March 1994.

The following points are relevant to the preparation of those accounts.

(a) Jasmin (Holdings) plc owns 90% of the ordinary £1 shares and 20% of the 10% £1 preference shares of Kasbah plc. On 1 April 1993 Jasmin (Holdings) plc paid £96 million for the ordinary £1 shares and £1.6 million for the 10% £1 preference shares when Kasbah’s reserves were a credit balance of £45 million.

(b) Jasmin (Holdings) plc sells part of its output to Kasbah plc. The stock of Kasbah plc on 31 March 1994 includes £1.2 million of stock purchased from Jasmin (Holdings)

plc at cost plus one-third.

(c) The policy of the group is to revalue its tangible fixed assets on a yearly basis. However the directors of Kasbah plc have always resisted this policy preferring to show tangible fixed assets at historical cost. The market value of the tangible fixed assets of Kasbah plc at 31 March 1994 is £90 million. The directors of Jasmin (Holdings) plc wish you to follow the requirements of FRS 2 ‘Accounting for Subsidiary Undertakings’ in respect of the value of tangible fixed assets to be included in the group accounts.

(d) The ordinary £1 shares of Fortran plc are split into 6 million ‘A’ ordinary £1 shares and 4 million ‘B’ ordinary £1 shares. Holders of ‘A’ shares are assigned 1 vote and holders of ‘B’ ordinary shares are assigned 2 votes per share. On 1 April 1993 Jasmin (Holdings)

plc acquired 80% of the ‘A’ ordinary shares and 10% of the ‘B’ ordinary shares when the profit and loss reserve of Fortran plc was £1.6 million and the revaluation reserve was £2 million. The ‘A’ ordinary shares and ‘B’ ordinary shares carry equal rights to share in the company’s profit and losses.

(e) The fair values of Kasbah plc and Fortran plc were not materially different from their book values at the time of acquisition of their shares by Jasmin (Holdings) plc.

(f) Goodwill arising on acquisition is amortised over five years.

(g) Kasbah plc has paid its preference dividend for the current year but no other dividends are proposed by the group companies. The preference dividend was paid shortly after the interim results of Kasbah plc were announced and was deemed to be a legal dividend by the auditors.

(h) Because of its substantial losses during the period, the directors of Jasmin (Holdings)

plc wish to exclude the financial statements of Kasbah plc from the group accounts on the grounds that Kasbah plc’s output is not similar to that of Jasmin (Holdings) plc and that the resultant accounts therefore would be misleading. Jasmin (Holdings) plc produces synthetic yarn and Kasbah plc produces garments.

Required

(a) List the conditions for exclusion of subsidiaries from consolidation for the directors of Jasmin (Holdings) plc and state whether Kasbah plc may be excluded on these grounds. (4 marks)

(b) Prepare a consolidated balance sheet for Jasmin (Holdings) Group plc for the year ending 31 March 1994. (All calculations should be made to the nearest thousand pounds.) (18 marks)

(c) Comment briefly on the possible implications of the size of Kasbah plc’s losses for the year for the group accounts and the individual accounts of Jasmin (Holdings) plc.

(3 marks)

ACCA, Accounting and Audit Practice, June 1994 (25 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey