Balmoral plc acquired 75% of the ordinary share capital and 30% of the preference share capital of

Question:

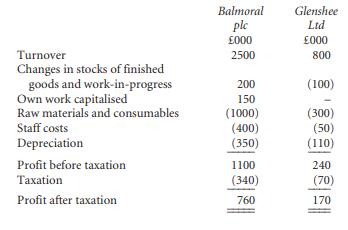

Balmoral plc acquired 75% of the ordinary share capital and 30% of the preference share capital of Glenshee Ltd for £2 million on 1 November 1994. The draft profit and loss accounts for the companies for the year ended 31 October 1998 were:

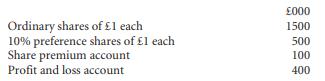

Additional information (1) The share capital and reserves of Glenshee Ltd at 1 November 1994 were:

There have been no subsequent changes to the share capital.

(2) The share capital of Balmoral plc comprises £2 million of 50p ordinary shares.

(3) The fair value of Glenshee Ltd’s fixed assets was £200 000 higher than their net book value at 1 November 1994 and they have a useful economic life of 10 years.

(4) On 31 July 1998, Glenshee Ltd sold goods to Balmoral plc for £50 000 on the basis of cost plus a mark-up of one-third. By 31 October 1998, £40 000 of the goods remained in Balmoral plc’s stock.

(5) Neither company has paid dividends in the year but both have proposed a final ordinary dividend of 5p per share and Glenshee Ltd proposes to pay the preference dividend in full. These proposed dividends are yet to be accounted for.

(6) Any goodwill arising is to be amortised over 10 years.

Requirements

(a) Prepare the consolidated profit and loss account of Balmoral plc for the year ended 31 October 1998. (10 marks)

(b) Discuss the benefits of consolidated accounts to the users of published financial statements. (5 marks)

ICAEW, Financial Reporting, December 1998 (15 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey