Richardson Corporation was created to develop computer software. On January 1, 20X3. Wealthy Company acquired 90 percent

Question:

Richardson Corporation was created to develop computer software. On January 1, 20X3. Wealthy Company acquired 90 percent of the common stock of Richardson Corporation in a business combination recorded as a pooling of interests. Wealthy Company continued to operate Richardson Corporation as a separate legal entity and used the basic equity method in accounting for its investment.

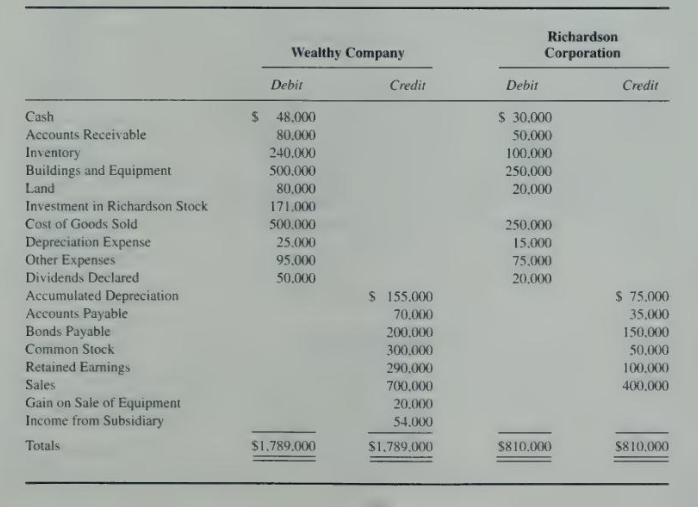

Trial balances for Wealthy Company and Richardson Corporation on December 31, 20X3, are as follows:

During 20X3, Richardson Corporation purchased inventory costing \(\$ 20,000\) and sold it to Wealthy Company for \(\$ 30.000\). Wealthy Company resold 60 percent of the inventory in \(20 \times 3\).

On January 2. 20X3. Wealthy Company sold equipment to Richardson Corporation for \(\$ 120,000\). The equipment had been purchased for \(\$ 150,000\) five years earlier by Wealthy Company and was depreciated on a straight-line basis with an expected life of 15 years. Richardson Corporation is depreciating the equipment over an expected 10 -year life on a straight-line basis. with no expected residual value.

\section*{Required}

a. Prepare a three-part consolidation workpaper in good form as of December 31, 20X3.

b. Prepare a consolidated income statement, balance sheet, and statement of changes in retained earnings for \(20 \mathrm{X} 3\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King