Select the correct answer for each of the following questions. 1 . Goodwill represents the excess of

Question:

Select the correct answer for each of the following questions.

1 . Goodwill represents the excess of the cost of an acquired company over the:

a. Sum of the fair values assigned to identifiable assets acquired less liabilities assumed.

b. Sum of the fair values assigned to tangible assets acquired less liabilities assumed.

c. Sum of the fair values assigned to intangible assets acquired less liabilities assumed.

d. Book value of an acquired company.

2. In a business combination accounted for as a purchase, costs of registering equity securities to be issued by the acquiring company are a(n):

a. Expense of the combined company for the period in which the costs were incurred.

b. Direct addition to stockholders" equity of the combined company.

c. Reduction of the otherwise determinable fair value of the securities.

d. Addition to goodwill.

3. Which of the following is the appropriate basis for valuing fixed assets acquired in a business combination accounted for as a purchase carried out by exchanging cash for common stock?

a. Historical cost.

b. Book value.

c. Cost plus any excess of purchase price over book value of assets acquired.

d. Fair value.

4. In a business combination accounted for as a purchase, the appraisal value of the identifiable assets acquired exceeds the acquisition price. The excess appraisal value should be reported as a:

a. Deferred credit.

b. Reduction of the values assigned to current assets and a deferred credit for any unallocated portion.

c. Pro rata reduction of the values assigned to current and noncurrent assets and a deferred credit for any unallocated portion.

d. No answer listed is correct.

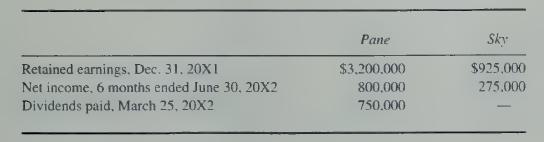

5. On June 30, 20X2, Pane Corporation exchanged 150,000 shares of its $20 par value common stock for all of Sky Corporation's common stock. At that date, the fair value of Pane's common stock issued was equal to the book value of Sky's net assets. Both corporations continued to operate as separate businesses, maintaining accounting records with years ending December 3 1 .

Information from separate company operations follows:

If the business combination is accounted for as a purchase, what amount of retained earnings would Pane report in its June 30, 20X2, consolidated balance sheet?

a. $5,200,000.

b. $4,450,000.

c. $3,525,000.

d. $3,250,000.

6. A and B Companies have been operating separately for five years. Each company has a minimal amount of liabilities and a simple capital structure consisting solely of voting common stock. A Company, in exchange for 40 percent of its voting stock, acquires 80 percent of the common stock of B Company. This was a "tax-free" stock-for-stock (type B) exchange for tax purposes.

B Company assets have a total net fair market value of $800,000 and a total net book value of $580,000. The fair market value of the A stock used in the exchange was $700,000. The goodwill on this acquisition would be:

a. Zero.

b. $60,000.

c. $120,000.

d. $236,000.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King