StarTech Ltd, whose functional currency is the Singapore dollar, has two subsidiaries: Maysub, which is located in

Question:

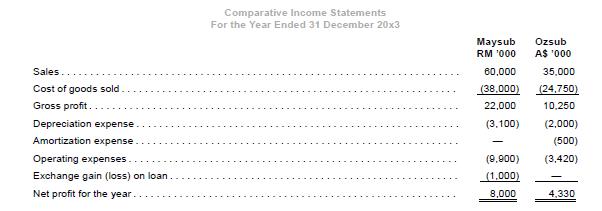

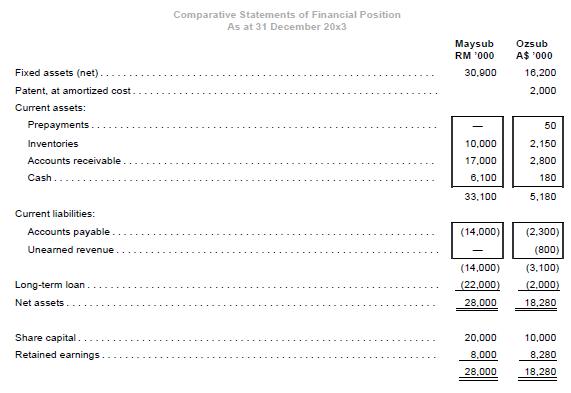

StarTech Ltd, whose functional currency is the Singapore dollar, has two subsidiaries: Maysub, which is located in Malaysia, and Ozsub, which is located in Australia. The financial statements of the two subsidiaries for the year ended 31 December 20x3 are as follows:

Additional information

(a) The Malaysian subsidiary was incorporated on 31 December 20x2 with a paid-up share capital of RM 20 million. On the same date, Maysub obtained a loan of S$10 million from a Singapore bank.

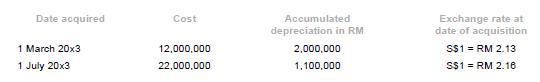

(b) Fixed assets of the Malaysian subsidiary comprised the following:

(c) The closing inventories of MaySub were acquired at an average rate of S$1 = RM 2.18.

(d) The Australian subsidiary was acquired on 31 December 20x1. At the date of acquisition, the subsidiary had a paid-up capital of A$10,000,000 and retained earnings of A$1,500,000. The exchange rate at the date of acquisition was A$1 = S$1.

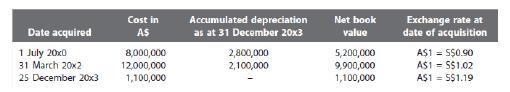

(e) Fixed assets of the Australian subsidiary comprise of the following

(f) Opening inventories (A$2,000,000) at 1 January 20x3 were acquired at an average exchange rate of A$1 = S$1.08. Closing inventories were acquired at an average rate of A$1 = S$1.17.

(g) The patent was acquired on 31 December 20x2. Amortization of the patent is on a straight line basis over five years.

(h) Prepayment is made up of prepaid insurance that was paid on 31 December 20x3 for the following year.

(i) The unearned revenue represents payments made in advance by certain customers at 31 December 20x3. The unearned revenue is refundable in the event that certain conditions are not met.

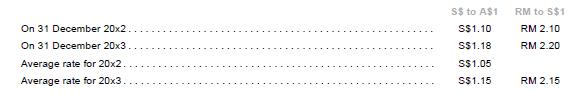

(j) Exchange rates:

Required

1. Quantify the translation exposure of the two subsidiaries as at 31 December 20x3.

2. Assume that the functional currency of the Malaysian subsidiary is the Singapore dollar and the functional currency of the Australian subsidiary is the Australian dollar.

Translate or remeasure, whichever is applicable, the financial statements of the two subsidiaries for the year ended 31 December 20x3.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah