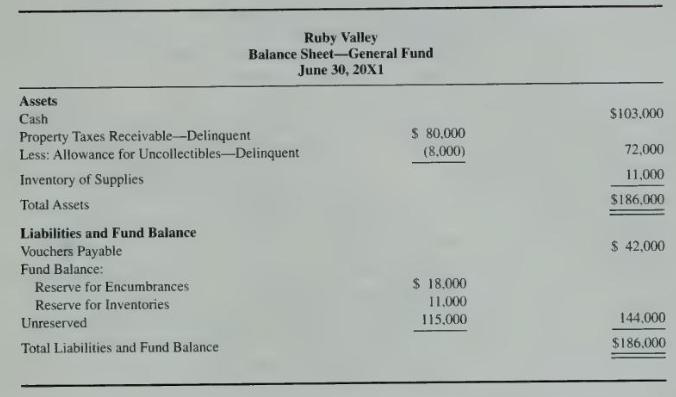

The balance sheet of the general fund of Ruby Valley on June 30, 20X1, follows: Budget and

Question:

The balance sheet of the general fund of Ruby Valley on June 30, 20X1, follows:

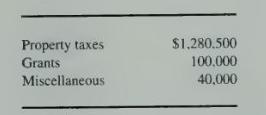

Budget and transaction information for fiscal 20X2 is as follows:

1. Estimated revenue:

The property tax levy was \(\$ 1,300,000\), of which uncollectible taxes were estimated at \(1 \frac{1}{2}\) percent.

2. Appropriations were \(\$ 1,356,000\) and estimated transfers out to internal service fund, \(\$ 25,000\). Ruby Valley uses the nonlapsing method to account for encumbrances. The appropriations included \(\$ 50,000\) for a new elevator.

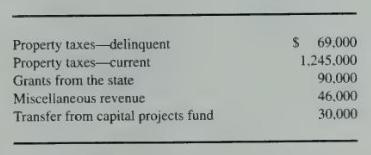

3. Cash receipts were as follows:

The remaining property taxes from fiscal 20X1 were written off, and those remaining from \(20 \times 2\) were reclassified. The allowance for uncollectibles for \(20 \times 2\) was reduced to \(\$ 7,500\).

4. The general fund issued purchase orders totaling \(\$ 1,336,000\), of which \(\$ 120,000\) were outstanding at year-end. Actual expenditures were \(\$ 1,240,000\), including \(\$ 20,000\) for \(20 \mathrm{X} 1\)

encumbrances, \(\$ 27,000\) for supplies, and \(\$ 45,000\) for a new elevator. Vouchers paid totaled \(\$ 1,227,000\). The supplies on hand June \(30,20 \mathrm{X} 2\), were \(\$ 6,700\). Ruby Valley uses the consumption method to account for inventories.

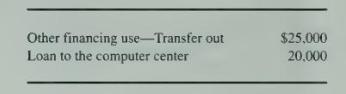

5. Other cash payments and transfers were as follows:

\section*{Required}

a. Prepare entries to summarize the general fund budget and transactions for fiscal 20X2 .

b. Prepare an unadjusted trial balance.

c. Prepare adjusting and closing entries for the general fund.

d. Prepare a balance sheet for the general fund as of June \(30,20 \mathrm{X} 2\).

e. Prepare a statement of revenues, expenditures, and changes in fund balance for fiscal \(20 \mathrm{X} 2\), for the general fund.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King