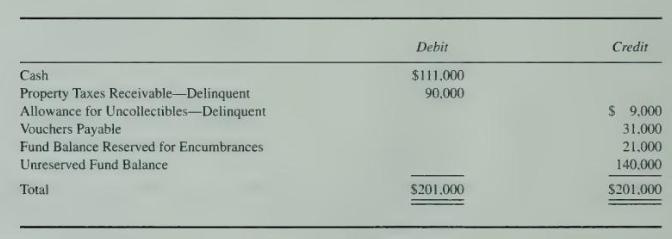

The postclosing trial balance of the general fund of the town of Pine Ridge on December 31,

Question:

The postclosing trial balance of the general fund of the town of Pine Ridge on December 31, 20X1. is as follows:

1. Estimated revenue: property taxes, \(\$ 1,584,000\) from a tax levy of \(\$ 1,600,000\) of which 1 percent was estimated uncollectible; sales taxes, \(\$ 250,000\); and miscellaneous, \(\$ 43,000\). Appropriations totaled \(\$ 1,840,000\); and estimated transfers out \(\$ 37,000\). Appropriations included outstanding purchase orders from \(20 \mathrm{X} 1\) of \(\$ 21,000\). Pine Ridge uses the lapsing method for outstanding encumbrances.

2. Cash receipts: property taxes, \(\$ 1,590,000\), including \(\$ 83,000\) from \(20 \mathrm{X} 1\); sales taxes, \(\$ 284,000\); licenses and fees, \(\$ 39,000\); and a loan from the motor pool, \(\$ 10,000\). The remaining property taxes from 20X1 were written off, and those remaining from \(20 \times 2\) were reclassified.

3. Orders were issued for \(\$ 1,800,000\) in addition to the acceptance of the \(\$ 21,000\) outstanding purchase orders from 20X1. A total of \(\$ 48.000\) of purchase orders still was outstanding at the end of \(20 \mathrm{X} 2\). Actual expenditures were \(\$ 1,788,000\), including \(\$ 42,000\) for office furniture. Vouchers paid totaled \(\$ 1,793,000\).

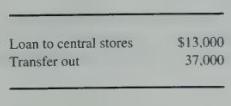

4. Other cash payments and transfers were as follows:

\section*{Required}

a. Prepare entries to summarize the general fund budget and transactions for \(20 \times 2\).

b. Prepare a preclosing trial balance.

c. Prepare closing entries for the general fund.

d. Prepare a balance sheet for the general fund as of December 31, \(20 \times 2\).

e. Prepare a statement of revenues, expenditures, and changes in fund balance for \(20 \mathrm{X} 2\) for the general fund.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King