The following financial activities affecting Johnson City's general fund took place during the year ended June 30,

Question:

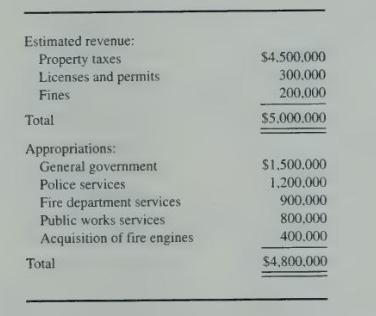

The following financial activities affecting Johnson City's general fund took place during the year ended June 30, 20X1. The following budget was adopted:

1. Property tax bills totaling \(\$ 4,650,000\) were mailed. It was estimated that \(\$ 300,000\) of this amount would be delinquent and \(\$ 150,000\) would be uncollectible.

2. Property taxes totaling \(\$ 3,900,000\) were collected. The \(\$ 150,000\) previously estimated to be uncollectible remained unchanged, but \(\$ 750,000\) was reclassified as delinquent. It is estimated that the delinquent taxes will be collected soon enough after June 30, 20XI, to make them available to finance obligations incurred during the year ended June \(30,20 \mathrm{X1}\). There was no balance of uncollected taxes on July 1,20X0.

3. Tax anticipation notes in the face amount of \(\$ 300,000\) were issued.

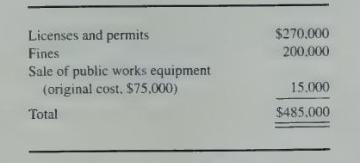

4. Other cash collections were as follows:

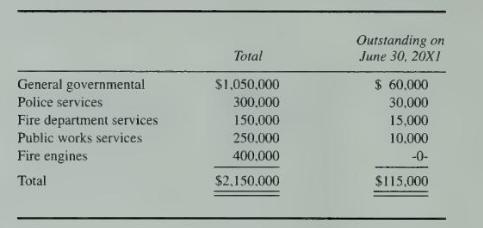

5. The following purchase orders were executed:

6. No encumbrances were outstanding on June 30, \(20 \times 0\).

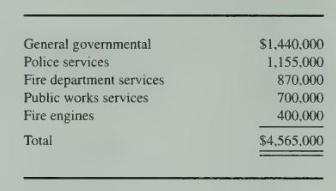

7. The following vouchers were approved:

8. Vouchers totaling \(\$ 4,600,000\) were paid.

\section*{Required}

Prepare journal entries to record the foregoing financial activities in the general fund, assuming separate appropriation and expenditure accounts are maintained for each function of the city. Ignore interest accruals.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King