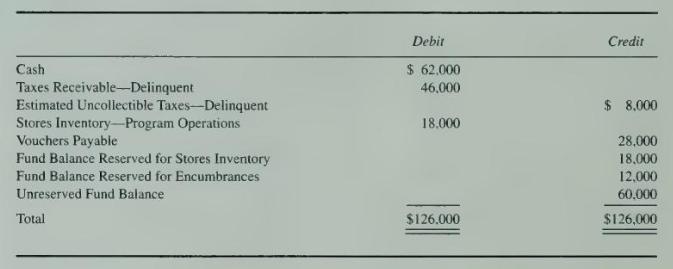

The general fund trial balance of the city of Prescott for December 31, 20X2, was as follows:

Question:

The general fund trial balance of the city of Prescott for December 31, 20X2, was as follows:

Collectible delinquent taxes are expected to be collected within 60 days after the end of the year. Prescott uses the purchases method to account for stores inventory and the nonlapsing method to account for encumbrances outstanding from a prior year. The following data pertain to 20X3 general fund operations:

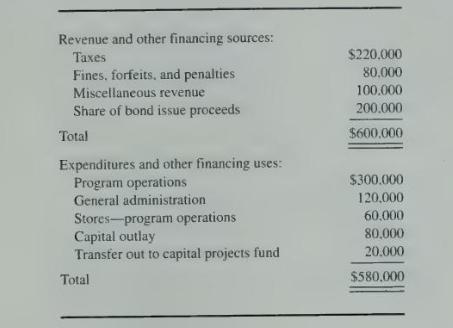

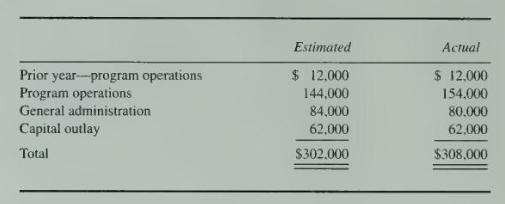

1. Budget adopted:

2. Taxes were assessed at an amount that would result in revenue of \(\$ 220,800\), after deduction of 4 percent of the tax levy as uncollectible.

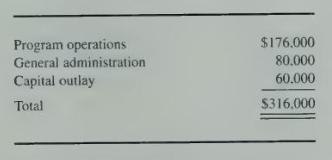

3. Orders placed but not received:

4. The city council designated \(\$ 20,000\) of the unreserved fund balance for possible future appropriation for capital outlay.

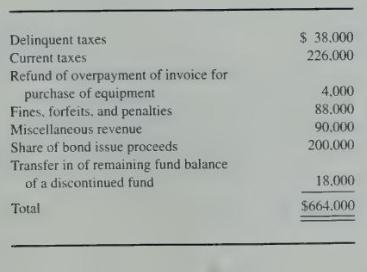

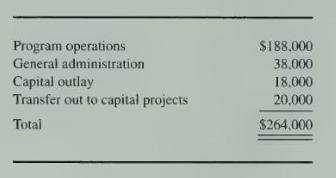

5. Cash collections and transfer:

6. The allowance for uncollectible taxes-current was reduced to \(\$ 3,000\). The remaining \(\$ 8,000\) of taxes receivable-delinquent were written off against the allowance for uncollectible taxes-delinquent.

7. Eliminated encumbrances for items received:

8. Additional vouchers:

9. Mr. Harris, a taxpayer, overpaid his \(20 \times 3\) taxes by \(\$ 2,000\). He applied for a \(\$ 2,000\) credit against his \(20 \mathrm{X} 4\) taxes. The city council granted his request.

10. Vouchers paid totaled \(\$ 580,000\).

11. Stores inventory on December \(31,20 \times 3\), amounted to \(\$ 12,000\).

\section*{Required}

Prepare journal entries to record the effects of the presented data, assuming Prescott maintains separate appropriation and expenditure accounts for each function of the city.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King