Thorne Ltd. is a wholly owned subsidiary of Fellows Corporation. The SFP, statement of comprehensive income, and

Question:

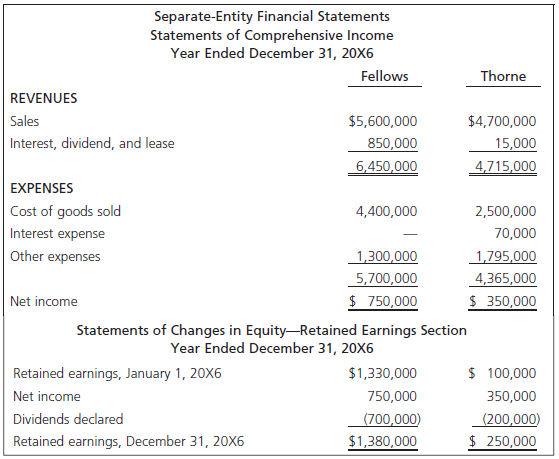

Thorne Ltd. is a wholly owned subsidiary of Fellows Corporation. The SFP, statement of comprehensive income, and retained earnings section of the statement of changes in equity for each company are shown below. Additional information is as follows:

1. Thorne sells most of its output to Fellows. During 20X6, intercompany sales amounted to $3,500,000. Fellows has accounts payable to Thorne for $20,000.

2. Fellows owns the land on which Thorne's building is situated. Fellows leases the land to Thorne for $30,000 per month.

3. The long-term note payable on Thorne's books represents a loan from Fellows. The note bears interest at 10% per annum.

4. Both companies declare dividends quarterly. The last quarter's dividends were declared on December 31, 20X6, payable on January 10, 20X7.

5. Fellows uses the cost method to account for its investment in Thorne.

Required

a. Prepare a consolidated SFP, SCI, and SCE/RE for Fellows Corporation.

b. What are the adjusting entries required if Fellows wishes to convert from the cost to the equity method to account for its investment in Thorne? How would Fellows' separateentity financial statements appear if it accounts for its investment in Thorne under the equity method?

c. Using Fellows' separate-entity financial statements under the equity method, prepare a consolidated SFP, consolidated SCI, and consolidated SCE/RE for Fellows Corporation.

Accounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay