Travis plc is a large grocery retailing and wholesaling organisation. It is presently drawing up its financial

Question:

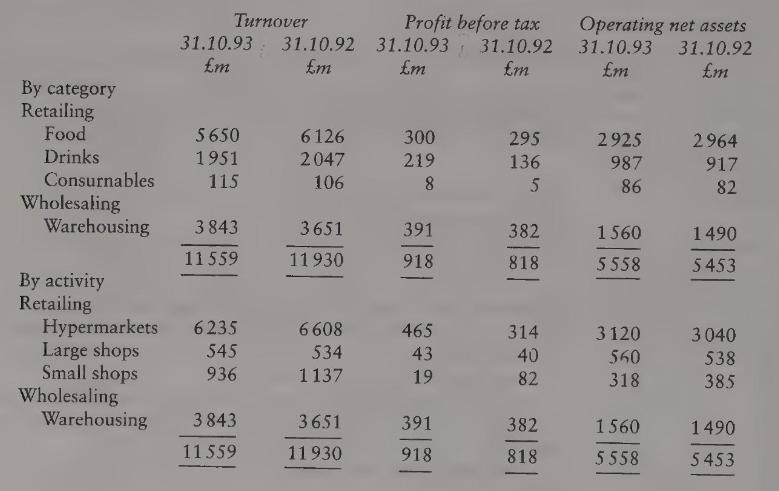

Travis plc is a large grocery retailing and wholesaling organisation. It is presently drawing up its financial statements for the year ended 31 October 1993 and, mindful of the requirements of SSAP 25, has drafted the following segmental report:

Segment information

Head office and service costs of \(£ 53\) million (1992: \(£ 51\) million) have been allocated according to the relative contribution of each segment to the total of continuing operations.

The group's borrowing requirements are centrally managed and so interest expense of \(£ 475\) million (1992: \(£ 415\) million) has been apportioned on the basis of average net assets for each segment.

Operating net assets represent the group's net assets adjusted to exclude interest bearing operating assets and liabilities.

Businesses discontinued during the year contributed \(£ 450\) million (1992: \(£ 850\) million) to turnover and \(£ 38\) million ( 1992 : \(£ 68\) million) to profit before tax.

\section*{Requirements}

(a) Discuss the objectives of segmental reporting in the context of each of the following user groups of financial statements:

(i) the shareholder group (ii) the investment analyst group (iii) the lender/creditor group (iv) Government.

(10 marks)

(b) Critically assess the presentation of Travis plc's draft 'Segment information' report, considering in particular its helpfulness to users of financial statements and its compliance with the requirements of SSAP 25 . Outline any ways in which the information might be presented more effectively or in which the treatment of items might be improved.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780273638339

6th Edition

Authors: Richard Lewis, David Pendrill