Use the data presented in Problem 1-27 to do the following: a. Record the combination on Boogie

Question:

Use the data presented in Problem 1-27 to do the following:

a. Record the combination on Boogie Musical Corporation's books assuming that the combination was treated as a pooling of interests and Boogie issued 9,000 of its \(\$ 10\) par common shares in exchange for Toot-Toot Tuba Company's assets and liabilities.

b. Present the capital section of Boogie's balance sheet immediately after the combination, assuming that the combination was treated as a pooling of interests and Boogie issued 26,000 shares of its common stock in exchange for all the assets and liabilities of Toot-Toot.

c. Record the combination on Boogie's books assuming that the combination was treated as a pooling of interests and Boogie issued 9,000 of its \(\$ 10\) par common shares to acquire all TootToot's common stock. Both companies retain their separate identities subsequent to the combination.

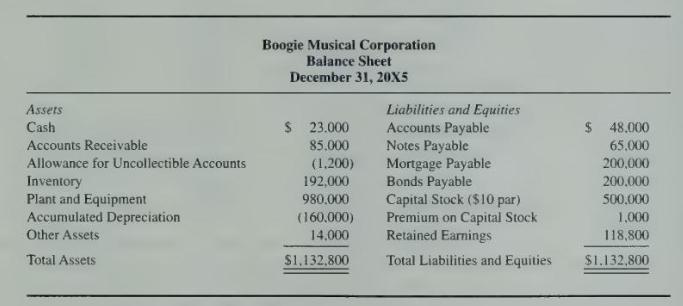

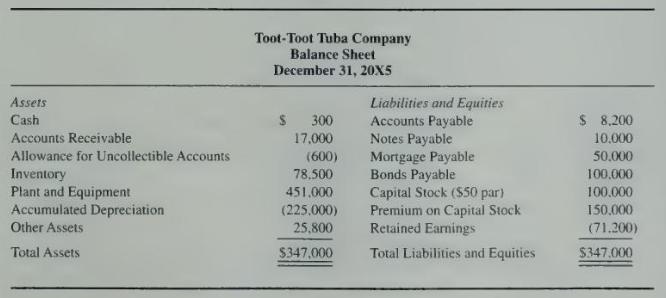

Data From Problem 1-27 Below are the balance sheets of the Boogie Musical Corporation and the Toot-Toot Tuba Company as of December 31, \(20 \mathrm{X} 5\).

In preparation for a possible business combination, a team of experts from Boogie Musical made a thorough examination and audit of Toot-Toot Tuba. They found that Toot-Toot's assets and liabilities were correctly stated except that they estimated uncollectible accounts at \(\$ 1,400\). They also estimated the market value of the inventory at \(\$ 35,000\) and the market value of the plant and equipment at \(\$ 500,000\). The business combination took place on January 1, 20X6, and on that date Boogie Musical acquired all the assets and liabilities of Toot-Toot Tuba. On that date, Boogie's common stock was selling for \(\$ 55\) per share.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King