Yam Manufacturing Corporation issued stock with a par value of ($ 67,000) and a market value of

Question:

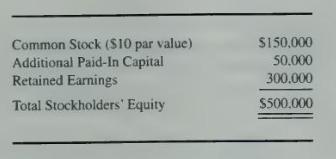

Yam Manufacturing Corporation issued stock with a par value of \(\$ 67,000\) and a market value of \(\$ 503.500\) to purchase 95 percent of the stock of Spencer Corporation on August 30, 20X1. On January 1, 20X1, Spencer Corporation reported the following stockholders' equity balances:

Spencer Corporation reported net income of \(\$ 60.000\) in \(20 \mathrm{X} 1\), earned uniformly throughout the year. Spencer declared and paid dividends of \(\$ 10,000\) on June 30 and \(\$ 25,000\) on December 31 . 20X1. Yarn Manufacturing accounts for its investment in Spencer Corporation using the equity method.

Yarn Manufacturing reported retained earnings of \(\$ 400,000\) on January 1, 20X1, and had 20X1 income from its separate operations of \(\$ 140,000\). Dividends of \(\$ 80,000\) were paid by Yam Manufacturing on December 31, 20X1.

\section*{Required}

a. Compute consolidated retained eamings as of January 1, 20X1, as it would appear in comparative consolidated financial statements presented at the end of \(20 \mathrm{X} 1\).

b. Compute consolidated net income reported for 20X1.

c. Compute consolidated retained eamings as of December 31, 20X1.

d Give the December 31, 20X1, balance of Yarn Manufacturing's investment in Spencer Corporation.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King