Compute the net present value (use a cost of money of 0.15) and the internal rate of

Question:

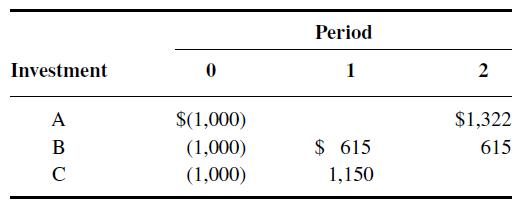

Compute the net present value (use a cost of money of 0.15) and the internal rate of return for each of the following investments:

Transcribed Image Text:

Investment A B C 0 $(1,000) (1,000) (1,000) Period 1 $ 615 1,150 2 $1,322 615

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

To calculate the Net Present Value NPV and Internal Rate of Return IRR for each investment youll nee...View the full answer

Answered By

Deepak Pal

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students. Areas of interest: Business, accounting, Project management, sociology, technology, computers, English, linguistics, media, philosophy, political science, statistics, data science, Excel, psychology, art, history, health education, gender studies, cultural studies, ethics, religion. I am also decent with math(s) & Programming. If you have a project you think I can take on, please feel welcome to invite me, and I'm going to check it out!

5.00+

1+ Reviews

10+ Question Solved

Related Book For

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman

Question Posted:

Students also viewed these Business questions

-

The net present value and internal rate of return desirability measures for two mutually exclusive investments being considered by Stockton Corporation to follow. Year NPV IRR R 161 14.60% S 138...

-

Ques 1: What is the major complaint by firms concerning the Sarbanes-Oxley act of 2012? A. the legislative maximum allowable compensation for a CEO. B. the legal requirement to disclose project...

-

21. DOES THE U.S DOLLAR INDEX WEAKEN IF THE US GROWTH ACCELERATES ? 22. THE U.S DOLLAR INDEX WEAKEN IF THE INTEREST RATE DIFFERENTIALS NARROW BETWEEN THOSE NATIONS ?

-

Protein Blenders, Inc., made a contract with Gingerich to buy from him the shares of stock of a small corporation. When the buyer refused to take and pay for the stock, Gingerich sued for specific...

-

The wing of an airplane has a polished aluminum skin. At a 1500 m altitude, it absorbs 100 W/m2 by solar radiation. Assuming that the interior surface of the wing??s skin is well insulated and the...

-

How has BI improved performance management at Quicken Loans?

-

Assume General Mills has to decide how to invest millions of dollars to try to expand its dessert and yogurt businesses. To allocate this money between these two businesses, what information would...

-

Discuss why variable pay-for-performance plans have become popular and what elements are needed to make them successful.

-

How to make a cash flow statement over a 3 year period? With the following figures from the income statement and balance sheet? Year 1 Year 3 $ 42,021 100.00% 100.00% $ 150,000 100.00% 33.33%...

-

The Arrow Company is considering the purchase of equipment that will return cash proceeds as follows: Assume a cost of money of 10 percent. What is the maximum amount the company could pay for the...

-

Prepare a schedule showing that, with a rate of growth of 0.15 per year, $1,000 will grow to $1,322 in two years.

-

After reading the material on the American business system and the German business system are you able to suggest why the German business system might be able to develop a more enlightened approach...

-

You are an external auditor in a firm that undertakes the audit of Canadian Life and Mutual (CLM), a large, Montreal-based financial institution. CLM relies heavily on its computer-based information...

-

You need to temporarily increase the feed rate to an existing column without flooding. Since the column is now operating at about \(90 \%\) of flooding, you must vary some operating parameter. The...

-

Consider, again, the clothing data set. Obtain the three summary plots of the sample cross-correlations for lags 1 to 21.

-

Based on the dangling-else discussion in Exercise 3.27, modify the following code to produce the output shown. Use proper indentation techniques. You must not make any additional changes other than...

-

Consider the random process \(U(t)=A\), where \(A\) is a random variable uniformly distributed on \((-1,1)\). (a) Sketch some sample functions of this process. (b) Find the time autocorrelation...

-

A circular conducting coil with radius 3.40 cm is placed in a uniform magnetic field of 0.880 T with the plane of the coil perpendicular to the magnetic field. The coil is rotated 180° about the...

-

Convert the numeral to a HinduArabic numeral. A94 12

-

Megan is an accountant for KnoxCo. She is a telecommuter and works most days from her home in Tennessee. Twice a month, she travels to Georgia for a staff meeting at the employer's Atlanta...

-

If a producer creates a really revolutionary new product and consumers can learn about it and purchase it at a website, is any additional marketing effort really necessary? Explain your thinking.

-

List your activities for the first two hours after you woke up this morning. Briefly indicate how marketing affected your activities.

-

Comfort Golf Products is considering whether to upgrade its equipment Managers are considering two options. Equipment manufactured by Stenback Inc. costs $1,000,000 and will last five years and have...

-

Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 71,000 shares of $10 par common stock. 8,500 shares of $60 par, 6 percent, noncumulative preferred stock. On...

-

Read the following case and then answer questions On 1 January 2016 a company purchased a machine at a cost of $3,000. Its useful life is estimated to be 10 years and then it has a residual value of...

Study smarter with the SolutionInn App