Jeff Jacobs is a junior accountant with the public accounting firm of Maxwell and King LLP. Jeff

Question:

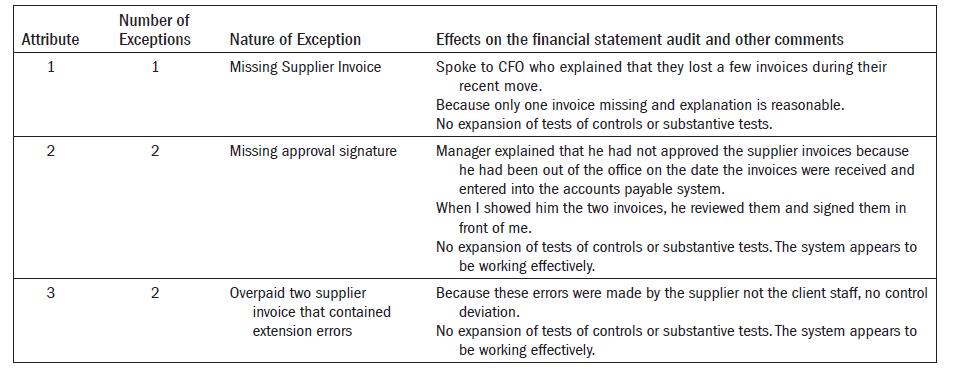

Jeff Jacobs is a junior accountant with the public accounting firm of Maxwell and King LLP. Jeff was assigned to do the audit of Astor Electronics Inc. The in-charge auditor informed Jeff that, based upon the procedures performed to obtain the understanding of the controls related to the procurement process, controls are effective and the preliminary assessment of control risk is low. Based upon this assessment, Jeff decided to perform test of controls over procurement transactions using attribute sampling. Jeff figured that a tolerable exception rate of 9 percent and a 5 percent ARO were appropriate for the tests he planned to perform. He had no idea how many deviations actually might exist in the population so he set the estimated population exception rate at 2 percent to be conservative. Based on his firm’s sampling guide, Jeff selected a sample of 70 items. Because Jeff believed larger items deserved more attention than smaller items, he selected 50 items with values greater than or equal to $2 500 and 20 items with values less than $2 500. He thought it would be most appropriate to select transactions near the end of the fiscal year, so he randomly selected items for testing from the last two months. Jeff was relieved when he found only five exceptions from the prescribed controls, and he concluded that none of them were control deficiencies and that the controls were operating effectively. Below is his documentation of the five deviations.

REQUIRED

a. Explain the deficiencies you note in Jeff’s sampling selection approach and his evaluation of the exceptions.

b. For the deficiencies you found explain how they impact the financial statement audit approach.

Step by Step Answer: