(a) Businesses often create an allowance for doubtful debts. (i) Of which concept (or convention) is this...

Question:

(a) Businesses often create an allowance for doubtful debts. (i) Of which concept (or convention) is this an example? Explain your answer. (ii) What is the purpose of creating an allowance for doubtful debts? (iii) How might the amount of an allowance for doubtful debts be calculated?

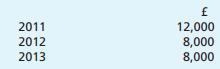

(b) On 1 January 2011 there was a balance of £500 in the an Allowance for Doubtful Debts Account, and it was decided to maintain the provision at 5% of the accounts receivable at each year end. The debtors on 31 December each year were:

Show the necessary entries for the three years ended 31 December 2011 to 31 December 2013 inclusive in the following: (i) the Allowance for Doubtful Debts Account; (ii) the Income Statements.

(c) What is the difference between bad debts and allowance for doubtful debts?

(d) On 1 January 2013 Warren Mair owed Jason Dalgleish £130. On 25 August 2013 Mair was declared bankrupt. A payment of 30p in the £ was received in full settlement. The remaining balance was written off as a bad debt. Write up the account of Warren Mair in Jason Dalgleish’s ledger.

Step by Step Answer:

Frank Woods Business Accounting

ISBN: 9780273759287

12th Edition

Authors: Frank Wood. Sangster, Alan