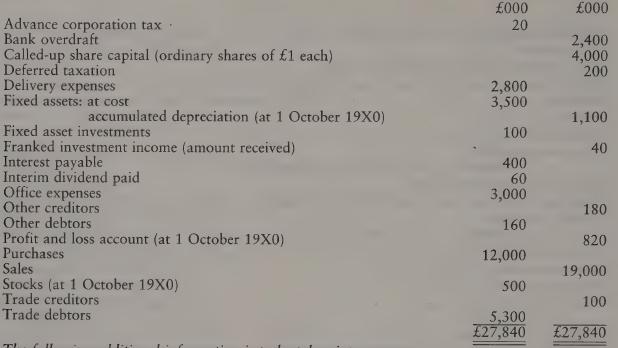

The following information has been extracted from the books of Quire plc as at 30 September 19X1.

Question:

The following information has been extracted from the books of Quire plc as at 30 September 19X1.

The following additional information is to be taken into account:

1 Stocks at 30 September 19X1 were valued at £400,000.

2 All items in the above trial balance are shown net of value added tax.

3 At 30 September 19X1, £130,000 was outstanding for office expenses, and £50,000 had been paid in advance for delivery van licences.

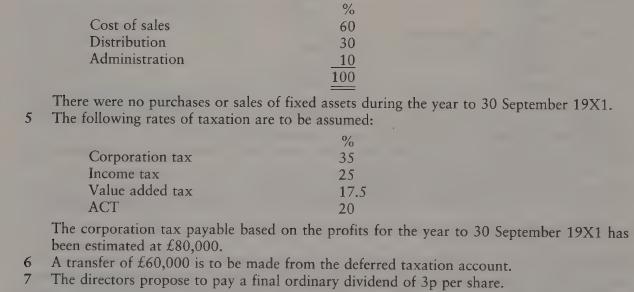

4 Depreciation at a rate of 50 per cent is to be charged on the historic cost of the tangible fixed assets using the reducing balance method: it is to be apportioned as follows:

Required:

Insofar as the information permits, prepare Quire plce’s profit and loss account for the year to 30 September 19X1, and a balance sheet as at that date in accordance with the MINIMUM requirements of the Companies Act 1985 and related accounting standards.

Note: Formal notes to the accounts are NOT required, but detailed workings should be submitted with your answer.

Step by Step Answer: