Graham and Stacy are having difficulty stretching their salaries to pay their bills. Before their marriage three

Question:

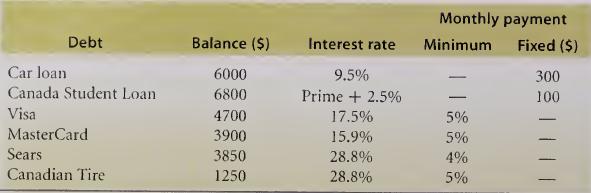

Graham and Stacy are having difficulty stretching their salaries to pay their bills. Before their marriage three months ago, they purchased new furnishings for their apartment. Then they paid for their honeymoon with “plastic.” Now the bills are all in. The following table lists their debts.

The minimum monthly payment on each credit card is the indicated percentage of the combined principal balance plus accrued interest. The prime rate of interest is 6.5%.

With a view to consolidating their debts, Stacy and Graham have discussed their personal financial position with the Personal Banking Representative (PBR) at the bank close to their new apartment. The PBR is prepared to approve a $20,000 joint line of credit at prime plus 3% on the condition that $6000 be used immediately to pay off the car loan (obtained from another bank). The minimum monthly payment would be 3% of the combined principal balance plus accrued interest.

QUESTIONS

1. Assuming 30 days interest on the indicated (principal) balances, what is the next minimum payment on each of the four credit cards?

2. If all the debt balances except the Canada Student Loan are consolidated in the new line of credit, what will be the first minimum payment? (Again assume a full 30 days’ accrued interest on the principal for the fairest comparison with the “status quo.”)

3. Based on the preceding results, what is the reduction in the first month’s total debt service payments?

4. With respect to credit card debt only, what is the reduction in the first month’s interest charges?

5. What (weighted) average interest rate are Graham and Stacy currently paying? What (weighted) average interest rate will they be paying after loan consolidation? (Include the Canada Student Loan in both calculations.)

6. Give two reasons why the PBR set the condition that Graham and Stacy use part of the line of credit to pay off the car loan.

7. Give two reasons why the PBR did not suggest a $27,000 line of credit and require that Graham and Stacy use the extra $7000 to pay off the Canada Student Loan.

Step by Step Answer: