37. Investment. Investment style plays a role in constructing a mutual fund. Each individual stock is grouped

Question:

37. Investment. Investment style plays a role in constructing a mutual fund. Each individual stock is grouped into two distinct groups: “Growth” and “Value.” A Growth stock is one with high earning potential and often pays little or no dividends to shareholders.

Conversely, Value stocks are commonly viewed as steady, or more conservative, with a lower earning potential. You are trying to decide what type of funds to invest in.

Because you are saving toward your retirement, if you invest in a Value fund, you hope that the fund remains conservative.

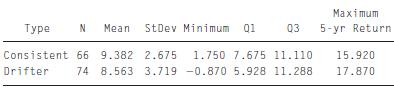

We would call such a fund “consistent.” If the fund did not remain consistent and became higher risk, that could impact your retirement savings. The funds in this data set have been identified as either being “style consistent” or “style drifter.” Portfolio managers wonder whether consistency provides the optimal chance for successful retirement, so they believe that style consistent funds outperform style drifters. Out of a sample of 140 funds, 66 were identified as style consistent, while 74 were identified as style drifters. Their statistics for their average return over 5 years are:

a) Write the null and alternative hypotheses.

b) Find the 95% confidence interval of the difference in mean return between style consistent and style drifter funds.

c) Is there a significant difference in 5-year return for these two types of funds? Explain.

Step by Step Answer:

Business Statistics

ISBN: 9780321716095

2nd Edition

Authors: Norean D. Sharpe, Paul F. Velleman, David Bock, Norean Radke Sharpe