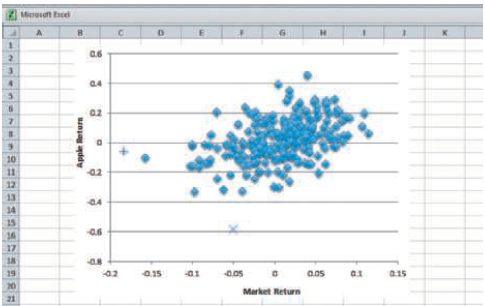

This data set tracks monthly performance of stock in Apple from January 1990 through December 2015, a

Question:

(a) Do these data meet the conditions of the SRM?

(b) Identify the time period associated with each of the two outliers highlighted in this scatterplot. What€™s special, if anything, about these two months?

(c) Which observation is more important to the precision of the estimated slope? That is, if we must drop one of these two but want to keep the standard error of the slope as small as possible, which month should be retained?

(d) Explain why the observation that keeps the t-statistic large is more influential than the other observation.

(e) Explain why removing either observation has little effect on the least squares fit.

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Statistics For Business Decision Making And Analysis

ISBN: 9780134497167

3rd Edition

Authors: Robert A. Stine, Dean Foster

Question Posted: