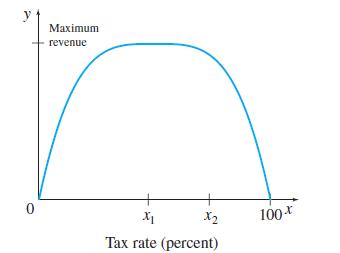

Exercises refer to the Laffer curve, originated by the economist Arthur Laffer. An idealized version of this

Question:

Exercises refer to the Laffer curve, originated by the economist Arthur Laffer. An idealized version of this curve is shown here. According to this curve, decreasing a tax rate, say from x2 percent to x1 percent on the graph, can actually lead to an increase in government revenue. The theory is that people will work harder and earn more money if they are taxed at a lower rate, so the government ends up with more revenue than it would at a higher tax rate. All economists agree on the endpoints—0 revenue at tax rates of both 0% and 100%—but there is much disagreement on the location of the tax rate x1 that produces the maximum revenue.

Find the equations of two quadratic functions that could describe the Laffer curve by having zeros at x = 0 and x = 100. Give the first a maximum of 100 and the second a maximum of 250, then multiply them together to get a new Laffer curve with a maximum of 25,000. Plot the resulting function.

Step by Step Answer: