Employers payroll taxes A companys payroll information for the month of May follows: On May 31 the

Question:

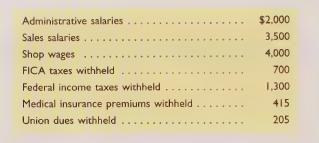

Employer’s payroll taxes A company’s payroll information for the month of May follows:

On May 31 the company issued Check No. 335 payable to the Payroll Bank Account to pay for the May payroll. It issued payroll checks to the employees after depositing the check. (1) Prepare the journal entry to record (accrue) the employer’s payroll for May. (2) Prepare the journal entry to pay the May payroll.

The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first \($7,000\) paid to each employee; the wages and salaries subject to these taxes were \($6,000\). (3) Prepare the journal entry to record the employer’s payroll taxes. (Refer to Chapter 9 if necessary in answering questions 1 and 2.)

Questions 1:

Computing gross pay

Compute gross pay for each of the following employees. An overtime rate of one and one-half times the

normal hourly wage is paid for each hour worked beyond 40 hours.

Questions 1:

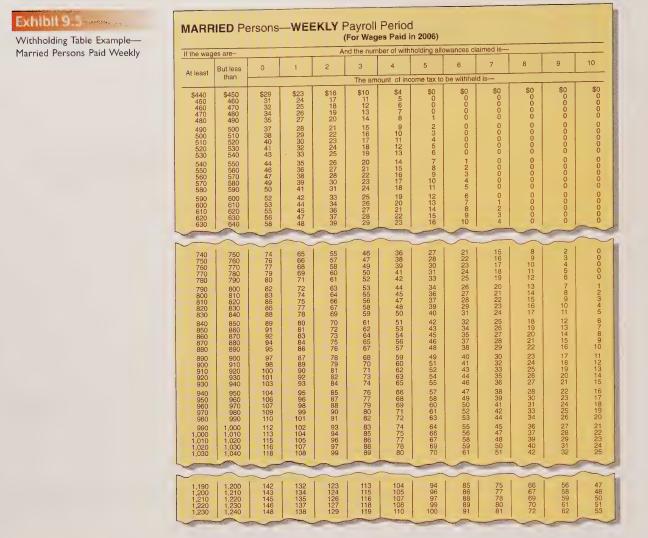

Computing tax withholdings

Nouri Hitzu’s cumulative earnings before this pay period were \($45,000\). Nouri’s gross pay for this weekly pay period was \($845\). What amounts will be withheld from Nouri’s pay for this period for federal income taxes? Nouri is married and claims a total of two withholding allowances. Nouri is paid weekly.(Use the tax withholding table in Exhibit 9.5).

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw