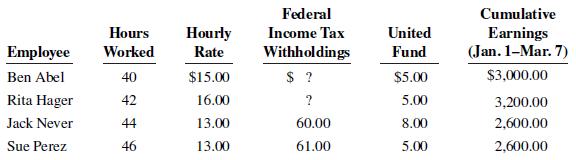

Mann Hardware has four employees who are paid on an hourly basis plus timeand-a-half for all hours

Question:

Mann Hardware has four employees who are paid on an hourly basis plus timeand-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15 are presented below.

Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128,400 and the Medicare tax rate of 1.45% on all salaries and wages. State income taxes are 3%.

Instructions

a. Prepare a payroll register for the weekly payroll. (Use the tax withholding table in Illustration 13.8 for federal income tax withholdings.)

b. Journalize the payroll on March 15.

c. Journalize the payment of the payroll on March 16.

Step by Step Answer:

College Accounting

ISBN: 1986

1st Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Deanna C. Martin, Jill E. Mitchell