Pauroll expenses, withholdings, and taxes Paloma Co. pays its employees each week. Its employees gross pay is

Question:

Pauroll expenses, withholdings, and taxes

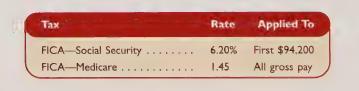

Paloma Co. pays its employees each week. Its employees’ gross pay is subject to these taxes:

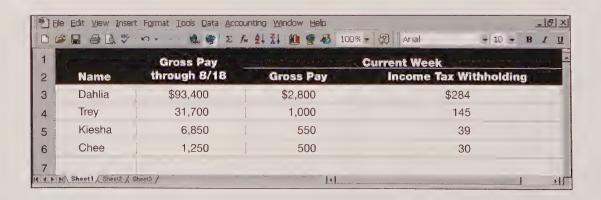

The company is preparing its payroll calculations for the week ended August 25. Payroll records show the following information for the company’s four employees.

In addition to gross pay, each employee must pay one-half of the \($34\) per employee weekly health insurance premium. Dahlia contributes 5% of her weekly gross pay to a retirement plan. Trey and Chee each contribute \($25\) per week to the local United Way.

Required

Compute the following for the week ended August 25 (round amounts to the nearest cent):

1. Each employee’s FICA withholdings for Social Security.

2. Each employee’s FICA withholdings for Medicare.

3. Each employee’s health insurance premium deduction.

4. Each employee’s other voluntary deductions.

5. Each employee’s net (take-home) pay.

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw