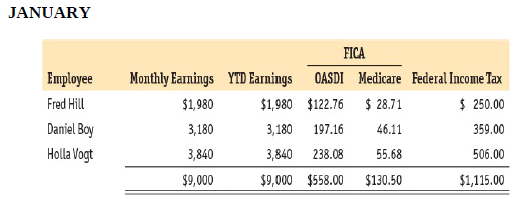

The following is the monthly payroll of White Company, owned by Dale White. Employees are paid on

Question:

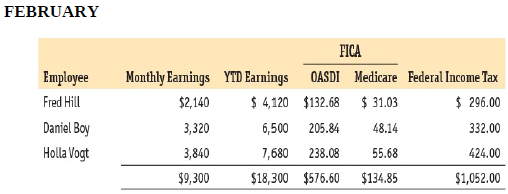

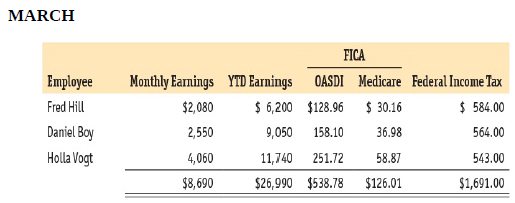

The following is the monthly payroll of White Company, owned by Dale White. Employees are paid on the last day of each month.

White Company is located at 2 Square Street, Marblehead, MA 01945. Its EIN is 29-3458822. The FICA tax rate for Social Security is 6.2% on up to $127,200 in earnings during the year, and Medicare is 1.45% on all earnings. The SUTA tax rate is 5.7% on the first $7,000 of earnings. The FUTA tax rate is 0.6% on the first $7,000 of earnings. White Company is classified as a monthly depositor for Form 941 taxes.

Your tasks are to do the following:

1. Journalize the entries to record the employer?s payroll tax expense for each pay period in the general journal.

2. Journalize entries for the payment of each tax liability in the general journal.

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 9780134729312

14th Edition

Authors: Jeffrey Slater, Mike Deschamps