The following transactions occurred in April for Jubilant Co.: Your tasks are to do the following: 1.

Question:

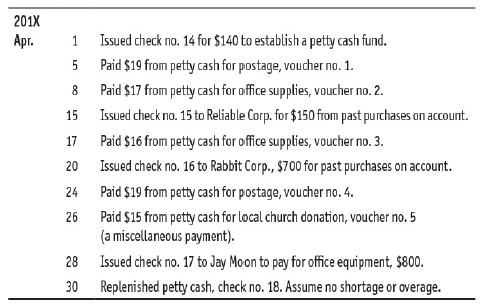

The following transactions occurred in April for Jubilant Co.:

Your tasks are to do the following:

1. Record the appropriate entries in the general journal as well as the auxiliary petty cash record as needed.

2. Replenish the petty cash fund on April 30 (check no. 18).

201X Арг. 1 Issued check no. 14 for $140 to establish a petty cash fund. Paid $19 from petty cash for postage, voucher no. 1. 8. Paid $17 from petty cash for office supplies, voucher no. 2. 15 Issued check no. 15 to Reliable Corp. for $150 from past purchases on account. 17 Paid $16 from petty cash for office supplies, voucher no. 3. 20 Issued check no. 16 to Rabbit Corp., $700 for past purchases on account. 24 Paid $19 from petty cash for postage, voucher no. 4. Paid $15 from petty cash for local church donation, voucher no. 5 (a miscellaneous payment). 26 28 Issued check no. 17 to Jay Moon to pay for office equipment, $800. 30 Replenished petty cash, check no. 18. Assume no shortage or overage.

Step by Step Answer:

GENERAL JOURNAL PAGE 4 Date 201X Account Titles and Description PR Dr Cr Apr 1 Petty Cash 1 4 0 0...View the full answer

College Accounting A Practical Approach

ISBN: 9780134729312

14th Edition

Authors: Jeffrey Slater, Mike Deschamps

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

The following transactions occurred in April for Joyous Co.: 201X Apr. 1 Issued check no. 14 for $125 to establish a petty cash fund. 5 Paid $13 from petty cash for postage, voucher no. 1. 8 Paid $16...

-

The following transactions occurred in April for Joyous Co.: 201X Apr. 1 Issued check no. 14 for $120 to establish a petty cash fund. 5 Paid $10 from petty cash for postage, voucher no. 1. 8 Paid $16...

-

The following transactions occurred in April for Exultant Co.: 201X Apr. 1 Issued check no. 14 for $150 to establish a petty cash fund. 5 Paid $20 from petty cash for postage, voucher no. 1. 8 Paid...

-

Gothic Kings Ltd. Is a 100% owned subsidiary of Hadrian Inc. Gothic has been profitable in the past but incurred a loss for the year ended December 31, 20X3. Hadrian has indicated that if Gothic...

-

Should the salary of BDCC's president be recorded as an asset since his salary brings benefits to the company in future accounting periods?

-

What are the roles and responsibilities of an effective and active Board of Directors? AppendixLO1

-

What other sports and industry could this type of event be adapted to?

-

Art Arfons, a K-State-educated engineer, has made a considerable fortune. He wishes to start a perpetual scholarship for engineering students at K State. The scholarship will provide a student with...

-

10.07 The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 17%, its before-tax cost of debt is 9%, and its marginal tax rate is 40%. Assume that the firm's...

-

1. Which of the following statements is true? a. Management accounting is guided by IFRS or Canadian ASPE. b. Management accounting information is mainly for external users. c. Management accounting...

-

From the following bank statement, please (1) complete the bank reconciliation for Tony?s Deli found on the reverse of the following bank statement and (2) journalize the appropriate entries as...

-

Slacks.com received a bank statement from Cobb Bank indicating a bank balance of $7,700. Based on Slacks.coms check stubs, the ending checkbook balance was $8,136. Your task is to prepare a bank...

-

Juvenile S.M.I. (16 years old) appeals from an adjudication of delinquency on a charge that, if committed by an adult, would constitute second-degree sexual assault, N.J.S.A. 2C:142c(1). We have...

-

1. Suppose we have two alternative designs, each of which yields a different present value of the total lifetime cost: the first is $1604 and the second is $1595. Verify that the present value of the...

-

Sometimes when we are asked for a linear model, the information that we are given is data about a scenario. In these cases we have to use Excel to generate a trendline. There is a video in this...

-

1. Purpose Explain 3 points from the Introduction section as to why this study is important. How did this study build on the existing literature in this area? 2. Participants Outline at least 2...

-

In this Capstone experience, you will develop a strategy playbook for a selected organization. You may be familiar with the concept of a playbook as it relates to a sports team, but what might that...

-

On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Cash Debit Credit $25,900 Accounts Receivable 46,500 Allowance for Uncollectible...

-

What are the two mechanisms by which energy of solar origin is transported around the earth? Which is more important?

-

D Which of the following is considered part of the Controlling activity of managerial accounting? O Choosing to purchase raw materials from one supplier versus another O Choosing the allocation base...

-

Why is the accounts receivable subsidiary ledger organized in alphabetical order?

-

List two drawbacks of the periodic inventory system.

-

What is the normal balance of Cost of Goods Sold?

-

A colleague of yours comes to you for advice. S/he's working on a project aimed at improving an urban 6-lane freeway section. This person says to you that the traffic flow for one direction during...

-

Edelman Engines has $18 billion in total assets. Its balance sheet shows $3.6 billion in current liabilities, $12.6 billion in long-term debt, and $1.8 billion in common equity. It has 500 million...

-

Q2 Calculate Net Sales, Cost of the goods Sold, Gross Profit and Net Profit from the following information Gross sales RO 53400 Bank charges RO1654 Cash RO 3200 Owners Equity RO 76000 Depreciation RO...

Study smarter with the SolutionInn App