Using a blank Form 941, complete Part 1, lines 1?6, using the following information: Total employees during

Question:

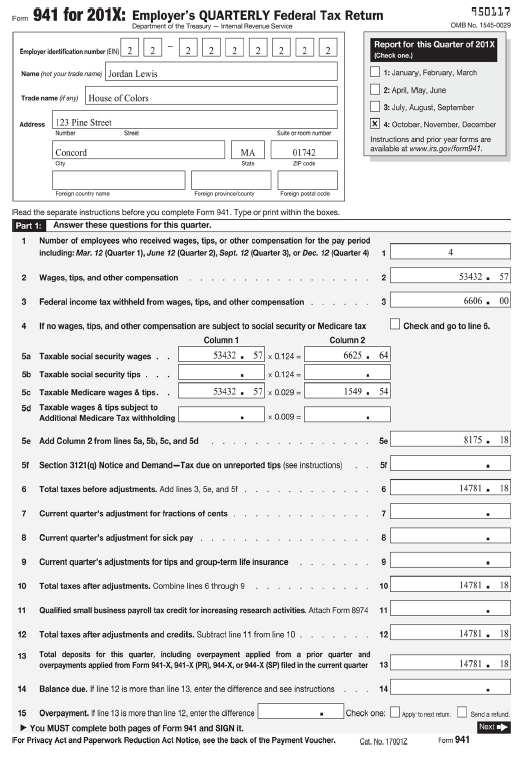

Using a blank Form 941, complete Part 1, lines 1?6, using the following information:

Total employees during the first quarter |

3 |

Total wages during the first quarter, none came from tips |

$26,800.15 |

Federal income tax withheld |

$2,025.00 |

Form 941

Transcribed Image Text:

Fom 941 for 201X: Employer's QUARTERLY Federal Tax Return 450117 Department of the Treasury - Intemal Revenue Service OMB No. 1545-0029 2 Report for this Quarter of 201X (Check one) Employer identification nunber (EN 2 Name net your trede nane Jordan Lewis 1: Jaruary, February, March 2: April, May, June Trade name fany House of Colors 3: July, August, September Address 123 Pine Street Number X 4: October, November, December See Sute or room umber Instructions and prior year forms are available at www.irs.gow/form941. Concord MA 01742 City State ZP code Foreign oountry neome Foreign provincecounty Foreign postal oode Read the separate instructions before you complete Form 941. Type or print within the boxes. Part 1: Answer these questions for this quarter. 1 Number of employees who received wages, tips, or other compensation for the pay period including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) 1 4 2 Wages, tips, and other compensation 53432. 57 3 Federal income tax withheld from wages, tips, and other compensation 3 6606. 00 If no wages, tips, and other compensation are subject to social security or Medicare tax Check and go to line 6. Column 1 Column 2 5a Taxable social security wages.. 53432. 57 x 0.124 - 6625. 64 5b Taxable social security tips. x 0.124 - 5c Taxable Medicare wages & tips. 53432. 57 x 0.029 - 1549. 54 5d Taxable wages å tips subject to Additional Medicare Tax withholding x 0.009 = 5e Add Column 2 from lines 5a, 5b, 5c, and 5d 5e 8175. 18 51 Section 3121(q) Notice and Demand-Tax due on unreported tips (see instructions) 51 6 Total taxes before adjustments. Add lines 3, 5e, and 5f 14781. 18 7 Current quarter's adjustment for fractions of cents Current quarter's adjustment for sick pay 8 Current quarter's adjustments for tips and group-term life insurance 10 Total taxes after adjustments. Combine lines 6 through 9 10 14781. 18 11 Qualified small business payroll tax credit for increasing research activities. Atach Form 8974 11 12 Total taxes after adjustments and credits. Subtract line 11 from line 10. 12 14781. 18 Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter 13 13 14781. 18 14 Balance due. F line 12 is more than line 13, enter the difference and see instructions 14 Overpayment. I ine 13 is more than line 12, enter the difference You MUST complete both pages of Form 941 and SIGN it. 15 Check one: UApply to net retun. Senda retund. Next For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Ct. No. 170012 Form 941

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 53% (13 reviews)

Line 1 Number of employees who received wages tips or other co...View the full answer

Answered By

Madhur Jain

I have 6 years of rich teaching experience in subjects like Mathematics, Accounting, and Entrance Exams preparation. With my experience, I am able to quickly adapt to the student's level of understanding and make the best use of his time.

I focus on teaching concepts along with the applications and what separates me is the connection I create with my students. I am well qualified for working on complex problems and reaching out to the solutions in minimal time. I was also awarded 'The Best Tutor Award' for 2 consecutive years in my previous job.

Hoping to get to work on some really interesting problems here.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

College Accounting A Practical Approach

ISBN: 9780134729312

14th Edition

Authors: Jeffrey Slater, Mike Deschamps

Question Posted:

Students also viewed these Business questions

-

Using a blank form 941, complete Part 1, lines 1-6, using the following information: Total employees during the first quarter ............................. 3 Total wages during the first quarter,...

-

Using the information from Problem 8B-4, please complete a Form 940 for Browns Sporting Goods for the current year. Additional information needed to complete the form is as follows: In Problem 8B-4,...

-

1 Use a form like Worksheet 11 2 to prepare a complete inventory of Col s investment holdings Note Look in the latest issue of The Wall Street Journal or pull up an online source such as http finance...

-

Superior Gaming, a computer enhancement company, has three product lines: audio enhancers, video enhancers, and connection-speed accelerators. Common costs are allocated based on relative sales. A...

-

In repeated attemps to synthesize the dipeptide ValLeu, aspiring peptide chemist Polly Styreen performs each of the following operations. Explain what, if anything, is wrong with procedure. The...

-

Which statement is least appropriate? Some of the features of the annual audit plan are as follows: a. It contains key audit areas for the next 12 months and explains why they were selected through a...

-

A summary of the December 31, 1995 balance sheet of Masonite Tires follows. (Long-term equity investments: the markto-market method versus the equity method) Assets $160,000 Liabilities $ 70,000...

-

An artificial tooth manufacturer sells teeth to distributors through a dealer network. The dealers sell to dental labs, which construct dentures for consumers. The manufacturer has spent a great deal...

-

Briefly define the term accountability and explain why the notion of social and environmental accountability is a greater focus of accounting today. (Word limit: at least 50 words)

-

Create a Budget Analysis Report for the month of September, to include creating a Master Budget, and calculating the variance analyses between Actuals versus the Flexible Budget and versus the Master...

-

Amador Company uses a special payroll account to pay employees. The gross amount of the payroll this week is $5,900; the net amount is $5,000. Journalize the transfer of funds to the payroll account...

-

At the end of April 201X, the total amount of OASDI, $550, and Medicare, $220, was withheld as tax deductions from the employees of Lucky, Inc. Federal income tax of $2,950 was also deducted from...

-

Financial models normally are said to be in balance when total assets equal total liabilities plus shareholders' equity on the balance sheet. How are financial models often forced to balance...

-

3. Environmental impact of adding feedwater heaters

-

1. Discuss the importance of genetic diversity in fish populations. 2. a) Habitat restoration and connectivity in population conservation is faced with many challenges. Discuss (5 marks) b)a) ...

-

1. Assumethatlengthin Oreochromis variabilis (Victoria Tilapia) ispolygenicvaryingfrom30cmto50cm. A 30cm purebred parent is crossed with another purebred 50 cm individual and the resulting F 1...

-

1. Using appropriate examples, compare and contrast the genetic diversity of marine fish species with freshwater fish species (8 marks) 2. Your class went on a trip and discovered a crater lake on...

-

Find sin(29) given that cos(0) = and 0

-

At equilibrium, a. both forward and reverse reactions have ceased b. the forward and reverse reactions are proceeding at the same rate c. the forward reaction has come to a stop, and the reverse...

-

You are planning to purchase your first home five years from today. The required down payment will be $50,000. You currently have $20,000. but you plan to contribute $500 each quarter to a special...

-

From the following transactions for Long Company for the month of January, a. prepare journal entries (assume that it is page 1 of the journal), b. post to the ledger (use a four-column account), and...

-

From the following transactions for Long Company for the month of January, a. prepare journal entries (assume that it is page 1 of the journal), b. post to the ledger (use a four-column account), and...

-

You have been hired to correct the trial balance below that has been recorded improperly from the ledger to the trialbalance. SANDY Co. TRIAL BALANCE JANUARY 31, 20 1X Dr Cr Accounts Payable A. Sandy...

-

Required information Great Adventures Problem AP5-1 [The following information applies to the questions displayed below.) Tony and Suzie are ready to expand Great Adventures even further in 2022....

-

Based on the following information, answer the questions below. The time from acceptance to maturity on a $2.25m Banker's Acceptance is 210 days. The importer's banks acceptance commission is 4% and...

-

As of Nov 21/2020, the price-to-earnings ratio of Tesla's competitor is 38.77. Tesla's earnings per share are $0.56. Tesla has 985.5 million shares outstanding. Based on the competitor, what is the...

The SAGE Encyclopedia Of Abnormal And Clinical Psychology 1st Edition - ISBN: 1483365832 - Free Book

Study smarter with the SolutionInn App