Question: Restore the file Boston Catering. Do not use the file created in the previous exercises. Add the following transactions and then print a standard balance

Restore the file Boston Catering. Do not use the file created in the previous exercises.

Add the following transactions and then print a standard balance sheet as of 8/31/10 and a standard income statement for the month ended 8/31/10:

a. On 8/6/10, the company contracted with a new customer, Boston College, terms net 15, that is subject to sales tax. The company anticipates many future engagements with this customer and thus created a new job (Event 1).

b. On 8/15/10, the company paid rent to New England Property Management (a new vendor) on check 1513 for $3,000.

c. On 8/16/10, the company contracted with MIT. The company anticipates many future engagements with this customer and thus created a new job (Dean Bumble).

d. On 8/21/10, the company paid all bills outstanding using checks 1514–1516.

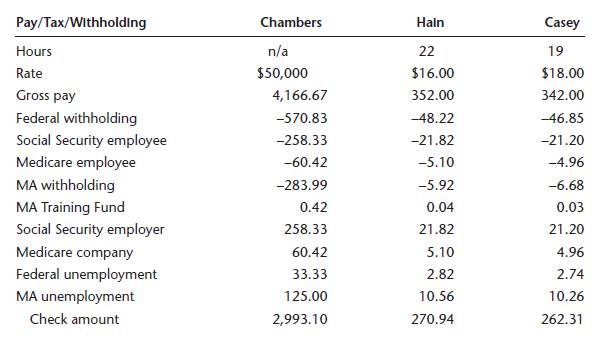

e. During the month of August, Kyle Hain worked 10 hours and Amy Casey worked 9 hours on 8/15 during the Boston College Event 1 party as wait staff. Kyle worked 12 hours and Amy worked 10 hours on 8/29 during the MIT Dean Bumble party as wait staff. Otherwise they did not work. Payroll checks are issued on 8/31/10 starting with check 1517. Paycheck information is shown next.

f. On 8/15/10, the company catered the Boston College Event 1 party. On 8/16/10, the company invoiced Boston College using invoice number 1123. They used 30 bottles of W100 and served 150 heavy appetizers (A100).

g. On 8/29/10, the company catered the MIT Dean Bumble party. On 8/30/10, the company invoiced MIT using invoice number 1124. They used 45 bottles of W201 and served 200 light appetizers (A200).

h. On 8/31/10, the company received a bill from US Food Service for \($800\) in food purchases for the Boston College event. A bill for the MIT party food purchases was expected next month.

i. On 8/31/10, the company paid sales tax due as of 8/31/10 using check 1520.

j. On 8/31/10, the company paid payroll liabilities due as of 7/31/10 using checks 1521 and 1522.

Pay/Tax/Withholding Hours Chambers Haln Casey n/a 22 19 Rate $50,000 $16.00 $18.00 Gross pay 4,166.67 352.00 342.00 Federal withholding -570.83 -48.22 -46.85 Social Security employee -258.33 -21.82 -21.20 Medicare employee -60.42 -5.10 -4.96 MA withholding -283.99 -5.92 -6.68 MA Training Fund 0.42 0.04 0.03 Social Security employer 258.33 21.82 21.20 Medicare company 60.42 5.10 4.96 Federal unemployment 33.33 2.82 2.74 MA unemployment 125.00 10.56 10.26 Check amount 2,993.10 270.94 262.31

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts