Short Tax Form purchases a fourplex on January 8, 2019, for ($175,000.) She allocates ($25,000) of the

Question:

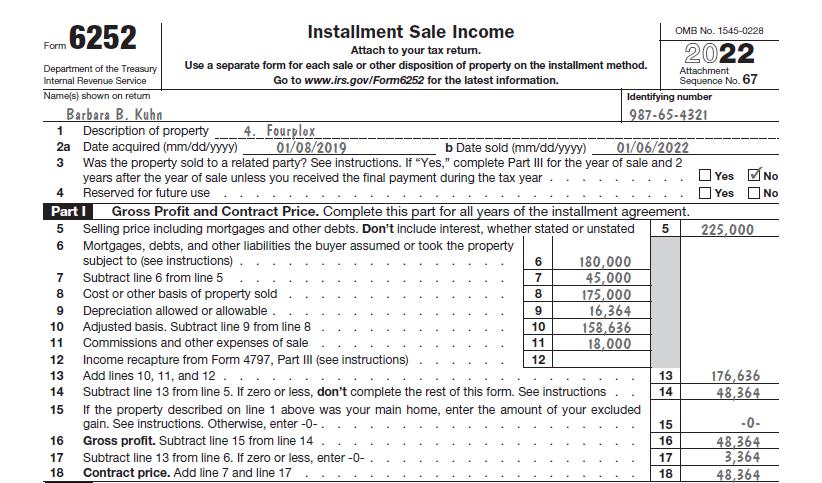

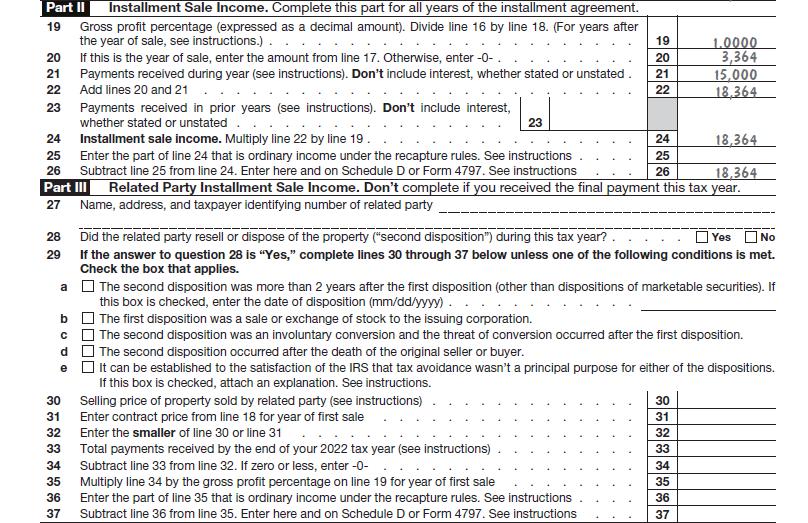

Short Tax Form purchases a fourplex on January 8, 2019, for \($175,000.\) She allocates \($25,000\) of the cost to the land, and she deducts MACRS depreciation totaling \($16,364.\) Barbara sells the fourplex to an unrelated person on January 6, 2022, for \($225,000.\) The buyer assumes the existing mortgage of \($180,000,\) pays \($15,000\) down, and agrees to pay \($15,000\) per year for two years plus 12% interest. Barbara incurs selling expenses of \($18,000.\) Complete Form 6252.

Data From Form 6252

Transcribed Image Text:

Form 6252 Department of the Treasury Internal Revenue Service Name(s) shown on return 1 Barbara B. Kuhn Installment Sale Income Attach to your tax return. Use a separate form for each sale or other disposition of property on the installment method. Go to www.irs.gov/Form6252 for the latest information. Description of property 2a Date acquired (mm/dd/yyyy) 4. Fourplex 01/08/2019 b Date sold (mm/dd/yyyy) OMB No. 1545-0228 2022 Attachment Sequence No. 67 Identifying number 987-65-4321 01/06/2022 3 Was the property sold to a related party? See instructions. If "Yes," complete Part III for the year of sale and 2 years after the year of sale unless you received the final payment during the tax year. 4 Reserved for future use Yes No Yes No Part I 56 5 Gross Profit and Contract Price. Complete this part for all years of the installment agreement. Selling price including mortgages and other debts. Don't include interest, whether stated or unstated Mortgages, debts, and other liabilities the buyer assumed or took the property 5 225,000 subject to (see instructions). 6 180,000 7 Subtract line 6 from line 5 7 45,000 8 Cost or other basis of property sold 8 175,000 9 Depreciation allowed or allowable. 9 16,364 10 Adjusted basis. Subtract line 9 from line 8 10 158,636 11 Commissions and other expenses of sale 11 18,000 12 Income recapture from Form 4797, Part III (see instructions) 12 13 Add lines 10, 11, and 12. 13 176,636 14 Subtract line 13 from line 5. If zero or less, don't complete the rest of this form. See instructions 14 48,364 15 If the property described on line 1 above was your main home, enter the amount of your excluded gain. See instructions. Otherwise, enter -0- . 15 -0- 16 17 618 Gross profit. Subtract line 15 from line 14 16 48,364 Subtract line 13 from line 6. If zero or less, enter -0- . 17 3,364 18 Contract price. Add line 7 and line 17 18 48,364

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson

Question Posted:

Students also viewed these Business questions

-

Short Tax Form. Barbara B. Kuhn (SSN 987-65-4321) purchases a fourplex on January 8, 2015, for $175,000. She allocates $25,000 of the cost to the land, and she deducts MACRS depreciation totaling...

-

Barbara B. Kuhn (SSN 987-65-4321) purchases a fourplex on January 8, 2013, for $175,000. She allocates $25,000 of the cost to the land, and she deducts MACRS depreciation totaling $16,364. Barbara...

-

Barbara B. Kuhn (SSN 987-65-4321) purchases a fourplex on January 8, 2012, for $175,000. She allocates $25,000 of the cost to the land, and she deducts MACRS depreciation totaling $16,364. Barbara...

-

(7b-4c-1)-2 (2b3c-2)5 Simplify.

-

Alex Roddick is the new owner of Ace Computer Services. At the end of August 2017, his first month of ownership, Roddick is trying to prepare monthly financial statements. Below is some information...

-

In Exercises verify that the infinite series diverges. n=0 4(-1.05)"

-

13. Consider a bull spread where you buy a 40-strike call and sell a 45-strike call. Suppose S = \($40\), = 0.30, r = 0.08, = 0, and T = 0.5. Draw a graph with stock prices ranging from \($20\) to...

-

The Atlantic Refinery Corporation ( ARC) is a public company headquartered in St. Johns, Newfoundland. On 31 December 20X5, the post- closing trial balance included the following accounts ( in...

-

Jamie Lee and Ross need to evaluate their emergency fund of $21,000. Will their present emergency fund be sufficient to cover them should one of them lose their job? Show the equation for calculating...

-

Hot & Cold and CaldoFreddo are two European manufacturers of home appliances that have merged. Hot & Cold has plants in France, Germany, and Finland, whereas CaldoFreddo has plants in the...

-

Explain why you would be more or less willing to buy a share of Verizon stock in the following situations: a. Your wealth falls. b. You expect it (Verizon stock) to appreciate in value. c. The bond...

-

Dan turned age 65 and retired this year. He owned and operated a tugboat in the local harbor before his retirement. The boat cost \($100,000\) when he purchased it two years ago. A tugboat is 10-year...

-

Innovation Inc. is considering the purchase of a new industrial electric motor to improve efficiency at its Fremont plant. The motor has an estimated useful life of five years. The estimated pretax...

-

According to a recent study, 21% of American college students graduate with no student loan debt. Suppose we obtain a random sample of 106 American college students and record whether or not they...

-

Differentiate the following with respect to x: a. y=5x+2x + x + 15 b. y=4x+3x - 4x - 10 c. y = 3Sin(5x) d. y = 3Cos(3x) e. y=10e -25x f. y = log(6x)

-

Question 2. The rate of drug destruction by the kidneys is proportional to the amount of the drug in the body. The constant of proportionality is denoted by K. At time t the quantity of the drug in...

-

5. 6. -1 (4a) U u X2 1 X2 -2 x -1 -2 12 (4b) U -2 2 Y y 16 x2 X2 3 1 (4c) U u - x 2 Y y -8 Y y -20 5 x X2 2 Find the state space models of the three systems shown in Fig. 4a, Fig. 4b, and Fig. 4c,...

-

Given the following data for Mehring Company, compute total manufacturing costs, prepare a cost of goods manufactured statement, and compute cost of goods sold. Direct materials used $230,000...

-

In a study of the effectiveness of please dont litter requests on supermarket fliers, Geller, Witmer, and Orebaugh (1976) found that the probability that a flier carrying a do not litter message...

-

The executor of Gina Purcells estate has recorded the following information: Assets discovered at death (at fair value): Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

Management makes many judgements and estimates in preparing accounts, some of which will have a significant effect on the reported results and financial position. Give examples of ZAIN estimates and...

-

What is the NPV of a project with an initial investment of $350,000 and annual cash inflows of $150,000 for the next 10 years? Cost of capital is 13% A $436,721.21 B $442,901.59 C $452,932.43 D...

-

Journal DATE DESCRIPTION POST. REF. DEBIT CREDIT 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Joumalize the entries for the following transactions. Refer to the Chart of Accounts for exact wording of...

Study smarter with the SolutionInn App