The Miller family has owned several large apartment buildings for many years. They organized Miller Properties, Inc.,

Question:

The Miller family has owned several large apartment buildings for many years. They organized Miller Properties, Inc., to own and manage the properties. The corporation is an accrual basis taxpayer and uses a calendar year. All shares of Miller Properties are owned by Frank, Susan, and their mother, Ida. Frank and Susan are president and chief financial officer of the corporation, respectively.

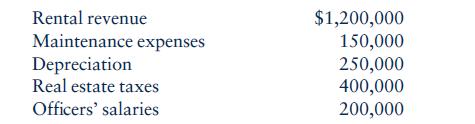

Miller Properties expects to have the following items of income and expense during the current year

Read and analyze Sections 541 through 547 and determine if Miller Properties has a problem with the personal holding company (PHC) tax. If it does, estimate the amount of PHC tax and suggest alternatives for reducing or eliminating the PHC problem.

Communication Skills

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins