Question:

Tracy M. Kidwell (SSN 433-33-3333) is single, 12 years old, and a dependent of her parents. She resides at 600 S. Maestri Place, New Orleans, LA 70130. Tracy’s only income is \($9,000\) of taxable interest, she does not have any itemized deductions, and she had no withholdings and made no estimated tax payments. Tracy’s parents (Kelly S. and James R. Kidwell) are married, file jointly, and list Kelly’s name first on their return (SSN 433-33-1111). Their taxable income is \($132,000\) (none of which is qualified dividends or long-term capital gains). Tracy does not have any transactions involving digital assets. Prepare Forms 1040 and 8615 for Tracy for 2022. Assume any estimated tax penalty is zero.

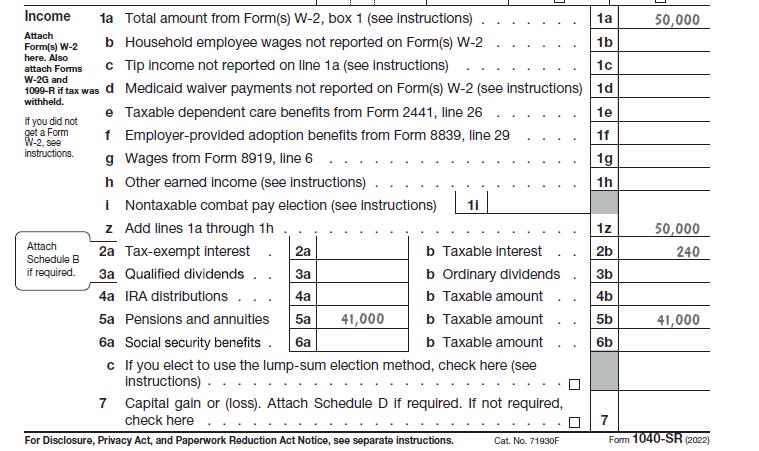

Data From Form 1040

Transcribed Image Text:

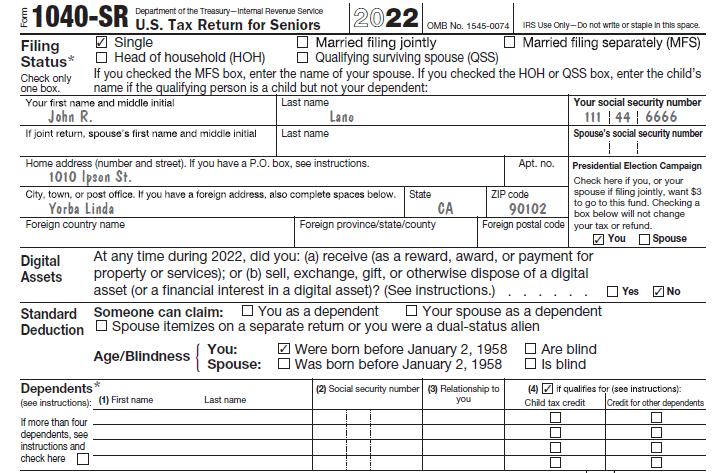

1040-SR US. Tax Return for Seniors Department of the Treasury-Internal Revenue Service Filing Status* Check only one box. Single Head of household (HOH) 2022 Married filing jointly OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Married filing separately (MFS) Qualifying surviving spouse (QSS) If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QSS box, enter the child's name if the qualifying person is a child but not your dependent: Your first name and middle initial Last name John R. Lano If joint return, spouse's first name and middle initial Last name Home address (number and street). If you have a P.O. box, see instructions. 1010 Ipson St. Apt. no. City, town, or post office. If you have a foreign address, also complete spaces below. State Yorba Linda ZIP code CA Foreign country name Foreign province/state/county 90102 Foreign postal code Digital Assets Your social security number 11144 6666 Spouse's social security number Presidential Election Campaign Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change your tax or refund. You Spouse At any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)? (See instructions.) Yes Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate retum or you were a dual-status alien Were born before January 2, 1958 Was born before January 2, 1958 Age/Blindness{ Dependents* (see instructions): (1) First name If more than four dependents, see instructions and check here You: Spouse: Last name Are blind Is blind (2) Social security number (3) Relationship to (4) Child tax credit you No if qualifies for (see instructions): Credit for other dependents