How does calculating depreciation using the IRS tables, such as Table 5-6, differ from calculating depreciation using

Question:

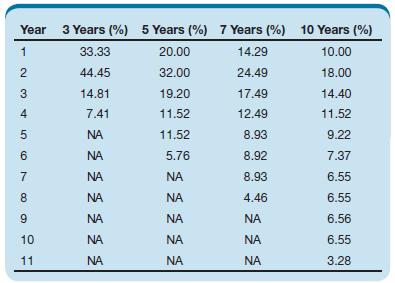

How does calculating depreciation using the IRS tables, such as Table 5-6, differ from calculating depreciation using declining balance method used Example 5-3?

In Table 5-6

Transcribed Image Text:

Year 1 234 5 6 7 8 9 10 11 3 Years (%) 5 Years (%) 7 Years (%) 10 Years (%) 33.33 20.00 14.29 10.00 44.45 32.00 24.49 18.00 14.81 19.20 17.49 14.40 7.41 11.52 12.49 11.52 ΝΑ 11.52 8.93 9.22 ΝΑ 5.76 8.92 ΝΑ 8.93 ΝΑ 4.46 ΝΑ ΝΑ NA ΝΑ ΝΑ ΝΑ ΝΑ ΝΑ ΝΑ ΝΑ ΝΑ 7.37 6.55 6.55 6.56 6.55 3.28

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (8 reviews)

The depreciation using the IRS tables is calculated ...View the full answer

Answered By

Anthony Ngatia

I have three academic degrees i.e bachelors degree in Education(English & Literature),bachelors degree in business administration(entrepreneurship option),and masters degree in business administration(strategic management) in addition to a diploma in business management.I have spent much of my life in the academia where I have taught at high school,middle level colleges level and at university level.I have been an active academic essays writer since 2011 where I have worked with some of the most reputable essay companies based in Europe and in the US.I have over the years perfected my academic writing skills as a result of tackling numerous different assignments.I do not plagiarize and I maintain competitive quality in all the assignments that I handle.I am driven by strong work ethics and a firm conviction that I should "Do Unto others as I would Like them to do to me".

4.80+

76+ Reviews

152+ Question Solved

Related Book For

Construction Accounting And Financial Management

ISBN: 9780132675055

3rd Edition

Authors: Steven J. Peterson

Question Posted:

Students also viewed these Business questions

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335. Carol is an Associate Professor of Accounting at a local...

-

An unknown compound A of molecular formula of C10H180 reacts with H2S04 and heat to form two compounds (B and C) of molecular formula C10H16. B and C both react with H2 over Pd/C to form decalin....

-

The deviation of a magnetic needle from the magnetic pole in a certain area in northern Canada is a normally distributed random variable with mean 0 and standard deviation 1.00. What is the...

-

If a worksheet is used, financial statements can be prepared before adjusting entries are journalized. T/F

-

Segment the training data set into red wines and white wines. Do the same for the test data set.

-

What assumptions do developers usually make while doing the initial use case realization?

-

How to find adjusted cash balance per bank

-

Why would a company use the sum-of-the-year or declining-balance methods to calculate depreciation?

-

What is a depreciation schedule?

-

Describe the characteristics of a learning organization. What are its advantages? LO4

-

Toro Corp. reports the following two years of balance sheets and some additional information. 2019 2018 Cash S 92,915 $ 31,355 Accounts receivable 94,000 80,850 Inventory 179,000 157,600 Prepaid...

-

The Westchester Chamber of Commerce periodically sponsors public service seminars and programs. Currently, promotional plans are under way for this year's program. Advertising alternatives include...

-

Mastery Problem: Differential Analysis and Product Pricing WoolCorp WoolCorp buys sheep's wool from farmers. The company began operations in January of this year, and is making decisions on product...

-

Ross Co. is an oil and gas company located in the Western United States. Ross follows U.S. GAAP in recording and reporting its financial transactions and has a year-end of 12/31. During the fiscal...

-

The following unadjusted trial balance is for ACE CONSTRUCTION CO. as of the end of its 2017 fiscal year. The June 30, 2016, credit balance of the owners capital account was $57,000, and the owner...

-

What is the standard of due care? How does it relate to due diligence?

-

Identify one local business that uses a perpetual inventory system and another that uses a periodic system. Interview an individual in each organization who is familiar with the inventory system and...

-

Determine the pretax and after-tax profit margins for the construction company in Figures 6-1 and 6-2. What insight does this give you into the companys financial operations? Figures 6-1 WEST...

-

Determine the return on assets for the construction company in Figures 6-1 and 6-2. What insight does this give you into the companys financial operations? Figures 6-1 WEST MOUNTAIN CONSTRUCTION...

-

Determine the pretax return on equity and after-tax return on equity for the construction company in Figures 6-1 and 6-2. What insight does this give you into the companys financial operations?...

-

thumbs up if correct A stock paying no dividends is priced at $154. Over the next 3-months you expect the stock torpeither be up 10% or down 10%. The risk-free rate is 1% per annum compounded...

-

Question 17 2 pts Activities between affiliated entities, such as a company and its management, must be disclosed in the financial statements of a corporation as O significant relationships O segment...

-

Marchetti Company, a U.S.-based importer of wines and spirits, placed an order with a French supplier for 1,000 cases of wine at a price of 200 euros per case. The total purchase price is 200,000...

Study smarter with the SolutionInn App